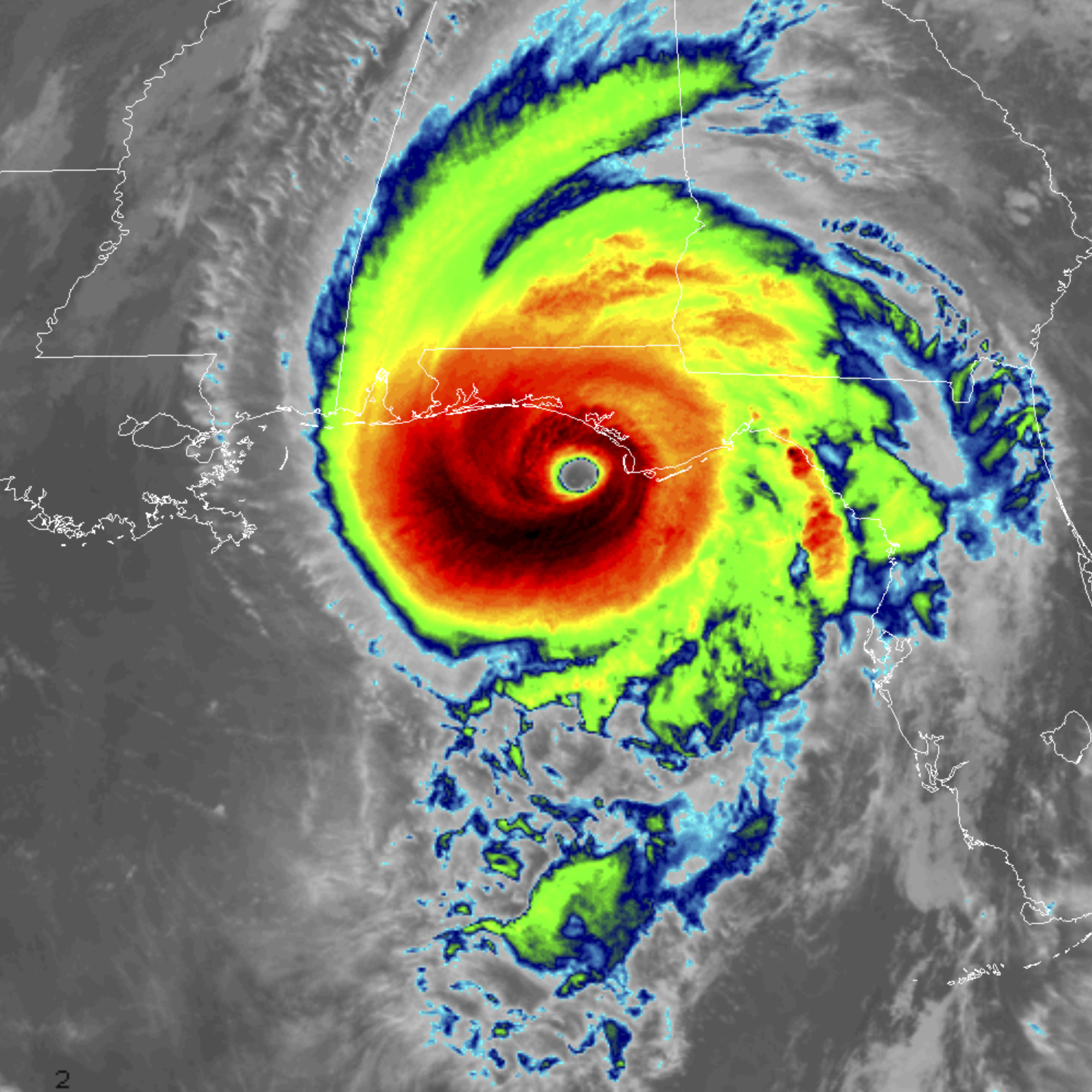

The costliest natural catastrophes occurred in the United States in 2018 with one of California’s devastating wildfires and Hurricane Michael...

Articles by L.S. Howard

Cyber incidents join business interruption as the top risks facing global businesses, according to a survey conducted by Allianz Global...

ArgoGlobal Assicurazioni S.p.A, a subsidiary of specialty re/insurer Argo Group International Holdings Ltd., is working with insurtech startup Axieme to...

Global reinsurance capital – comprising traditional and alternative capital – fell 2 percent in 2018 to US$595 billion from $605...

Liberty Mutual has once again directly tapped capital markets’ reinsurance capacity via the Bermuda collateralized reinsurance sidecar, Limestone Re Ltd....

The costliest natural catastrophes occurred in the United States in 2018 with one of California’s devastating wildfires and Hurricane Michael...

Assicurazioni Generali SpA announced the closing of the sale of its entire stake in Generali Belgium SA to Athora Holding...

Mergers & acquisitions drew a lot of interest from the readers of Insurance Journal’s International section in 2018 with 11...

Cornelius Vander Starr had many identities, including American entrepreneur, successful businessman, salesman, fearless world traveler and business pioneer. As the...

Liberty Mutual Insurance has formed a $1 billion risk-sharing agreement with the Overseas Private Investment Corp. (OPIC), the U.S. government’s...