This article is part of a sponsored series by Cotality.

As history has shown, disasters can happen anywhere and at any time. However, some areas around the globe experience more than their fair share of severe weather including hail, wildfires, flooding, tornadoes, hurricanes, earthquakes, winter storms, lightning strikes and sinkholes.

Ten months into 2014, we have already experienced a parade of strange weather events around the world, from searing heat to one of the coldest winters in decades, and also flooding so severe which we haven’t seen in more than a century¹. Among the most bizarre was the lack of winter in parts of the drought-stricken western U.S., including California¹. January was the warmest and driest on record in San Francisco, San Jose and Los Angeles¹. Parts of the West were also battling wildfires in January and continue to do so now with 22 active large fires currently burning around the nation². Many parts of the Midwest, however, saw the coldest winter this year since the late 1970s and early 1980s¹. To add to the global mix of extreme weather, Tokyo was blanketed with 11 inches of snow in February, England and Wales were drenched by their wettest December-January period since 1976-77, and Australia sweated through days of record heat early in 2014¹.

In the U.S. specifically, geography, climate and size make some states far more disaster-prone than others. Figures current as of the end of May 2014 and going back more than 60 years show that presidents have declared nearly 2,000 major disasters in the 50 states and the District of Columbia³.

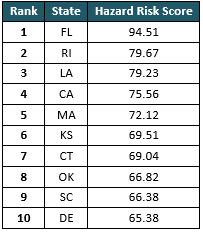

Top 10 U.S. States with Highest Hazard Risk

(Ranked by CoreLogic Hazard Risk Score)

This extreme weather begs several important questions for both insurers and homeowners: Where do we expect these frequent and sometimes severe events to occur in the future? And, more importantly, are homeowners and insurers making sure that ample coverage is in place to protect assets and finances?

For properties around the U.S., the Hazard Risk Score has been created to help solve these issues. Sophisticated analysis and scoring can be used to predict the risk of loss from multiple natural hazard events, as well as the associated probability of potential financial losses. Probability or the frequency of hazard events is a significant factor in determining the risk levels, as traditionally, a higher risk level indicates a higher probability that a risk event will occur.

Insurance companies can use hazard scoring for a variety of insights including:

- Providing clarity to risk management

- Assess effectiveness of underwriting and loss control

- Risk assessment across states

- Territory price smoothing across state boundaries

- Accurate Enterprise Risk Management (ERM) assumptions and testing

- Marketing/risk selection

When evaluating hazard risk, it’s important to identify the distinct differences and risk exposures in underlying hazards. In certain scenarios, it’s also advantageous to evaluate specific locations even more closely to identify which hazards contribute the most risk and/or the exact risk levels of the underlying hazards. This geospatial precision is the key to assessing all risks at any given location, and differences in the underlying hazard risk levels between properties in close proximity should be reflected in comprehensive scoring.

Identifying the riskiest areas across the nation enables insurers to take action to reduce risk in over-concentrated places and prepare to deploy resources to respond at the locations with the highest risk concentrations. Are you writing insurance policies in one of these risky states? Learn more here.

SOURCES:

1. The Weather Channel, “10 Crazy Weather Events of 2014.”

2. National Interagency Fire Center, 2014.

3. Bankrate.com, “10 Riskiest States for Disasters.”

Was this article valuable?

Here are more articles you may enjoy.

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call  Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer  India’s GIFT City Attracts Lloyd’s and Other Global Reinsurers, Sources Say

India’s GIFT City Attracts Lloyd’s and Other Global Reinsurers, Sources Say  Zurich Reveals Beazley Stake After UK Insurer Spurns Bid

Zurich Reveals Beazley Stake After UK Insurer Spurns Bid