This post is part of a series sponsored by CoreLogic.

Owning a home is one of the largest investments most Americans will ever make and yet few homeowners understand that comprehensive sinkhole coverage is not part of a standard homeowner’s insurance policy. And, as the sinkhole risk in Florida continues to rise, homeowners are finding themselves both uninsured and out of luck¹.

Why then does a sinkhole occur? Although made famous by the sunshine state, a sinkhole can realistically occur in any place where a subsurface void can form. In the case of Florida, the entire state sits on top of thousands of feet of limestone, a porous and permeable sedimentary rock that over time can dissolve and leave behind a large underground void². When the overlying soil or surface matter collapses into the void, a sinkhole is formed.

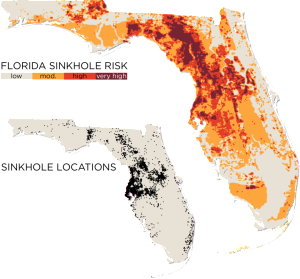

Sinkholes can be both naturally occurring or brought on by human factors such as when ground water is used for irrigation or consumption through increased residential development. With over 23,000 sinkholes identified in the ever expanding CoreLogic sinkhole database (Map 1), it is clear that Florida residents can continue to expect future property damage as a result of sinkhole activity³.

Although Florida is the state most well-known and active for sinkhole events, it was Kentucky that experienced the most newsworthy sinkhole event of 2014. In February, a sinkhole opened underneath the floor of the National Corvette Museum in Bowling Green, Kentucky. A total of eight Corvettes that were on display in the museum fell into the sinkhole and were later removed. The value of the eight rare cars is several million dollars, and the cost to repair the museum is estimated at more than 3 million dollars4. Another sinkhole that caused noteworthy damage in 2014 also occurred in Florida, in the town of Spring Hill. A large sinkhole opened up in July and eventually grew to 120 feet in diameter leaving several homes destroyed in its wake5.

While nobody can predict when the next disaster will strike, we do know where sinkholes events are most likely to occur. CoreLogic is able to provide a comprehensive map of the closest sinkhole(s) within a ½ mile and 1 mile radius of the subject, helping to further mitigate risk and avoid impending disaster.

By helping homeowners understand their potential risk and exposure to sinkholes, preventative measures can be taken to assure maximum effectiveness should a disaster occur. Insurance companies and disaster response teams alike can benefit from accurate and timely information regarding sinkhole probability, so stay alert and don’t let sinkhole coverage fall through the cracks.

Learn More

For more information about CoreLogic Florida Sinkhole Risk data, click here, call us at (855)-267-7027 or email us at hazardrisk@corelogic.com.

CoreLogic (NYSE: CLGX) is a leading property information, analytics and services provider. The company’s combined public, contributory and proprietary data sources include over 3.3 billion records spanning more than 40 years. The company helps clients identify and manage growth opportunities, improve performance and mitigate risk. For more information visit www.corelogic.com.

¹ In Florida, Sinkhole Risks Grow With Urban Expansion, Businessweek.com, 2013.

² Facts About Sinkholes in Florida, wfla.com, 2014.

³ CoreLogic, 2013.

4 Motor Trend, “Repairing National Corvette Museum Sinkhole to Cost $3.2 Million,” 2014.

5 Fox News, “Massive Sinkhole threatens homes, draws gawkers in Florida neighborhood,” 2014.

Topics Florida Homeowners

Was this article valuable?

Here are more articles you may enjoy.

Three Charged With Helping Agents Cheat on Florida Insurance License Exams

Three Charged With Helping Agents Cheat on Florida Insurance License Exams  Changes at American Coastal Insurance After Florida OIR Action on ‘No-Fly List’

Changes at American Coastal Insurance After Florida OIR Action on ‘No-Fly List’  Microsoft Tells Texas Agencies They Were Exposed in Russian Hack

Microsoft Tells Texas Agencies They Were Exposed in Russian Hack  US Roof Maintenance Lags: Hanover

US Roof Maintenance Lags: Hanover