This article is part of a sponsored series by Cotality.

Preparing for a catastrophe is a science. This science involves models built from data and analytics that can capture the worst-case scenario for businesses and homeowners. Knowing exactly what the worst looks like allows people to better prepare for it. But the impact of a hurricane doesn’t end with the last drop of rain—nor does a wildfire’s as the last ember flickers out.

Natural disasters affect insurance companies which do their best to understand a home’s risk; reinsurance companies who grapple with aggregate risk; banks and mortgage companies who face risk to assets and find challenges ensuring customers have immediate access to local branches; the real estate industry which sees pricing pressure; and homeowners, families and businesses who do their best to just make it through in one piece.

Events like 2017’s trio of hurricanes – Harvey, Irma and Maria – caused serious delinquency rates[1] on home mortgages to triple in the Houston, Texas, and Cape Coral, Florida, metro areas and quadruple in San Juan, Puerto Rico.[2]

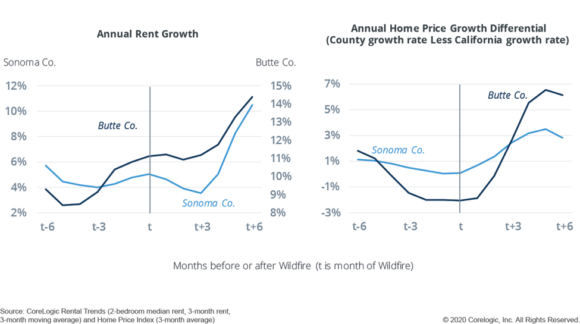

On top of delinquencies, loss of housing stock also affects the cost of shelter in affected neighborhoods. The Camp Fire, for instance, incinerated about 20% of the single-family housing stock in Butte County and the Tubbs Fire destroyed about 6% of the single-family homes in Santa Rosa in Sonoma County.[3], [4] For some of the affected neighborhoods, the loss was close to 100%. Families displaced by the fire add to the demand for shelter in the local area. The increase in demand, coupled with the reduction in housing stock, translates into upward pressure on prices and rent for undamaged homes.

What does this mean for 2019’s disasters?

Based on CoreLogic research, communities affected by wildfires, hurricanes, floods, tornadoes, earthquakes and other natural disasters in 2019 will likely experience an increase in mortgage delinquencies and shelter costs, and it can take more than 12 months for mortgage delinquency rates to normalize—and even longer for homes to be repaired or rebuilt. Though not as devastating as the prior three years, 2019 was an eventful year, complete with powerful hurricanes, tornadoes, hailstorms, floods, earthquakes and wildfires. The tornadoes in Dayton, Ohio, and Dallas, Texas, were among the most costly catastrophes to have occurred on record for each state. Hurricane Dorian devastated the Bahamas, with losses reportedly exceeding one-third of the country’s $12 billion gross domestic product. Typhoon Hagibis put much of Japan underwater, with an estimated 30% of the flood damage uninsured.

According to the National Oceanic and Atmospheric Administration (NOAA), 2019 had at least 14 events with losses exceeding $1 billion in the United States alone—more than double the annual adjusted average (from 1980 to 2018) of 6.5 events per year.[5]

In those same 40 years, the average annual total losses is $6.5 billion. Comparatively, the average for the most recent five years alone has more than doubled at $13.8 billion. 2019 marked the seventh year in the last decade in which 10 or more weather and climate disasters exceeding $1 billion have occurred. In the past 40 years, there have been only two other years this has happened: 1998 and 2008.

The cumulative effect of high-loss events, both in 2019 and throughout the decade past, penetrate deeply into our connected world of finance – personal equity, insurance and our mortgage finance economies. Improving the data and analytics surrounding natural catastrophes helps us all by making our society more resilient.

For more information on insights gained from 2019’s catastrophes, including economic and financial implications, as well as a lookback on market-changing moments of the decade past, read the CoreLogic 2019 Natural Hazard Report.

[1] The serious delinquency rate is the percent of loans that are 90-days-or-more delinquent or in foreclosure proceedings.

[2] “2017 Atlantic Hurricane Season,” National Hurricane Center and Central Pacific Hurricane Center

[3] “Incidents Overview,” California Department of Forestry & Fire Protection (CAL FIRE)

[4] “Nearly 3,000 homes destroyed by Sonoma County wildfire,” KCRA October 2017

[5] “U.S. Billion-Dollar Weather and Climate Disasters (2019),” NOAA, National Centers for Environmental Information (NCEI)

Topics Catastrophe Trends Wildfire Hurricane

Was this article valuable?

Here are more articles you may enjoy.

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals  Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’

Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’  Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme

Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme