This post is part of an Insurance Journal blog presenting the work and viewpoints of The International Center for Law & Economics.

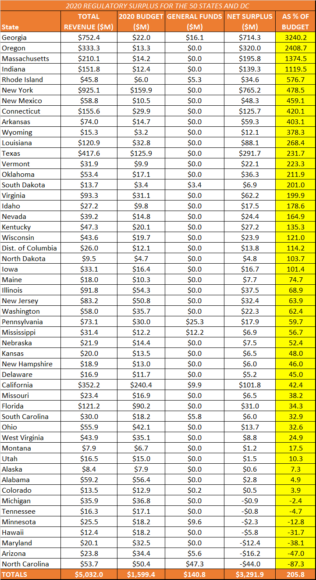

The COVID-19 pandemic hit state budgets particularly hard in 2020, with a $24.11 billion drop in tax revenue collected from 2019’s levels. But analysis of National Association of Insurance Commissioners (NAIC) data demonstrates that insurance regulation remained a profitable revenue source for the states, generating $3.29 billion in budgetary surpluses across the 50 states and the District of Columbia, up from $2.94 billion in 2019.

According to data from the Federation of Tax Administrators, the states’ total tax collections fell 2.2% from $1.090 trillion in 2019 to $1.066 trillion in 2020, with Utah (down 12.4%), North Dakota (down 12.8%) and Alaska (down 26.0%) hit hardest of all. Altogether, 31 states and the District of Columbia saw tax revenues fall, with California alone down a precipitous $16.27 billion.

By contrast, the NAIC’s 2020 Insurance Department Resources Report shows that state insurance departments collected $3.77 billion in regulatory fees and assessments, up 12.9% from $3.34 billion in 2019. Combined with the $190.6 million in fines and penalties departments collected (roughly flat from 2019) and $1.07 billion of miscellaneous “other” revenue, state insurance departments generated $5.03 billion of total revenues, more than three times the $1.60 billion they actually spent on insurance regulation.

That $3.43 billion of “regulatory surplus” (up 11.8% from $3.07 billion in 2019) must be weighed against the $140.8 million in funds that insurance departments drew from their states’ general funds, itself a 5.4% increase over 2019. But even after subtracting that total, insurance regulation remained a profit center for states, with $3.29 billion of surplus revenues, up 12.1% from $2.94 billion in 2019.

A Tax By Any Other Name

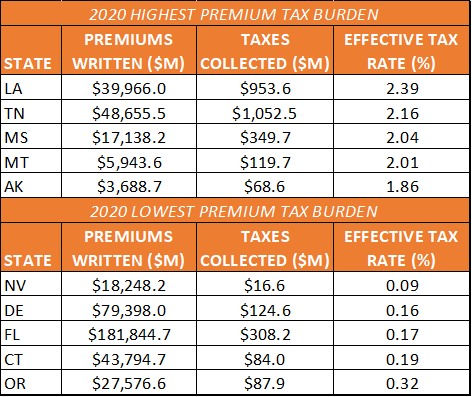

The revenues collected by insurance departments—whether they be fees and assessments, fines and penalties, or funds from other sources—should not be confused with the taxes that states assess on insurance premiums. All states collect taxes on the premiums written within that state and most also collect “retaliatory” taxes, charging out-of-state insurers the rate set by their domiciliary state if it is higher than the rate in the jurisdiction where the premium is written. The existence of retaliatory taxes pushes most insurers to domicile in relatively low-tax jurisdictions. The states with the highest and lowest effective premium tax rates in 2020 are displayed in the graph above.

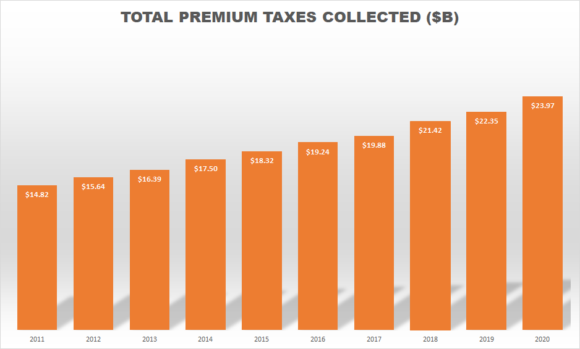

Premium and retaliatory taxes are deposited in a state’s general fund, just as other sales taxes are. Kansas is a partial exception, in this respect, as the Kansas Insurance Department retains 1% of the premium taxes collected, which it reports as “other” revenue. As demonstrated in the graph below, premium taxes have been a stable and largely recession-proof revenue source for the states, growing 61.7% over the past decade from $14.82 billion in 2011 to $23.97 billion in 2020.

But as noted, the fees and fines collected by insurance departments significantly exceed the amounts strictly needed to support regulatory activities. In 2020, just seven state insurance departments (North Carolina, Arizona, Maryland, Hawaii, Minnesota, Michigan and Tennessee) raised less in revenue than the combination of what they spent on regulation and what they received from their state’s general fund. In fact, the total amount the states spent on insurance regulation in 2020 ($1.36 billion) represented just 31.8% of the revenues that insurance regulators raised.

The rest of the funds—the so-called “regulatory surplus”—amount to a hidden tax on insurance companies, which is ultimately passed on to consumers in the form of more expensive coverage.

Following the Money

State insurance departments differ in how their budgets are structured and what happens to the funds raised by regulators. A slim majority of states (27 in all) employ “dedicated” budgets, in which revenues flow into a separate account that is carried over from year to year. If revenues flowing into the account exceed the budget appropriated by the state legislature for that year, the excess is carried over into future years and may be used to cover future departmental shortfalls.

In theory, the benefit of a dedicated funding system is to reduce cyclical fluctuations in revenue. For example, a department could collect large fines and penalties that serve as a one-time windfall. For example, Texas reported that $19.2 million of the $67.6 million of fines and penalties the state collected in 2020 were from a single entity, while Vermont noted that one large settlement accounted for $1.8 million of the $2.2 million in fines it reported.

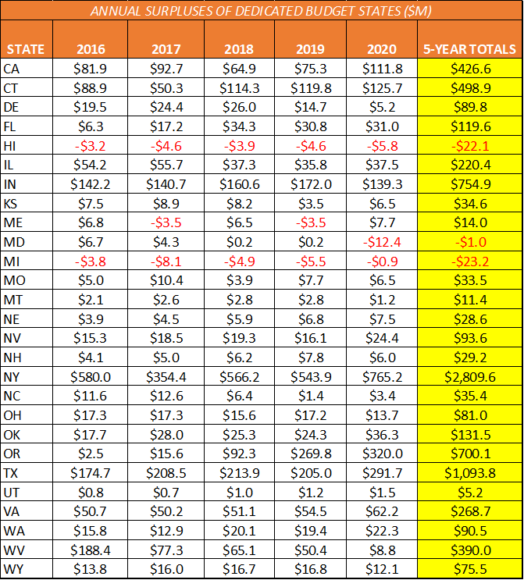

A dedicated funding budget also should theoretically mitigate any need for a department to either cut expenditures or call on general funds from a state’s treasury. But as the table below illustrates, there are some discrepancies between that theoretical account and how departments with dedicated budgets perform in the real world.

As is evident, the vast majority of dedicated budget states—24 of the 27—have raised more in revenues than they’ve spent on insurance regulation in each of the past five years. Two other states, Hawaii and Michigan, have recorded shortfalls in each of the past five years. Only Maine and Maryland actually performed as the theoretical account would predict, running shortfalls in some years and surpluses in others.

Moreover, in some cases, the surpluses are truly enormous. The cumulative $2.81 billion five-year surplus generated by New York, or the $1.09 billion five-year surplus generated by Texas, cannot reasonably be characterized as a prudential “rainy-day fund.” Both states are obviously overcharging insurers and insurance producers for regulatory and licensing fees by a massive amount.

Also undercutting the theoretical account is that four of the states with dedicated insurance department budgets nonetheless also received at least some funds from their states’ treasuries in the past five years, despite all four posting surpluses each year. Two of those departments have received only very limited general funds, with none in 2020. (Oklahoma received $1.6 million in general funds in 2016, but none in the past four years. Washington State received a combined roughly $500,000 in 2016 and 2017, but none in the past three years.)

California, which often draws a small portion of its annual budget from the state treasury, has taken $21.6 million in general funds over the past five years. The true outlier is North Carolina. Despite posting a combined $35.4 million in surpluses the past five years, the department also drew a whopping $209.8 million in general funds from the state over the same period.

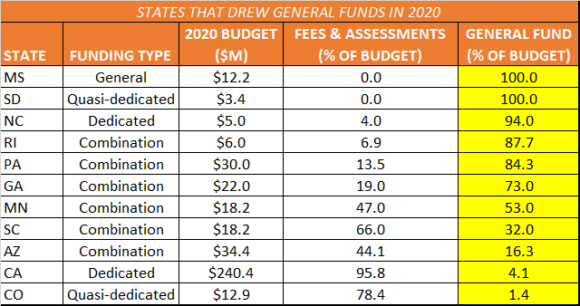

Only 11 states drew any general funds from their state treasuries in 2020, but they came from all four of the budget types identified by the NAIC: dedicated (covered above), quasi-dedicated (excess revenues are deposited annually in the state’s general account), general (all operating funds are allocated directly by the state) and “combination” (the department’s budgeting rules employ a combination of two or more of the other types).

While Mississippi and South Dakota are the only states that draw 100% of their funding from the general fund, only Mississippi is formally categorized as a “general funding” state, a change took effect in 2017. Notably, while Mississippi does continue to collect regulatory fees and assessments from companies, as of 2020, it no longer reports such funds, which are all deposited in the state’s general account.

Mississippi’s failure to report the regulatory fees and assessments it collects notwithstanding, for the 23 states (and the District of Columbia) that do not employ dedicated budgets, budget surpluses generated by insurance regulation serve even more directly as a tax. Excess funds are usually, but not always, deposited in the state’s treasury. There are some partial exceptions. Arkansas allows the department to carry over excess funds for one year, but surrenders any surpluses to the general fund every other year. Alaska and North Dakota both allow their departments to carry over $1 million to the following year, with the remainder transferred to the general fund.

Among states without dedicated funds, only Arizona and Tennessee spent more on insurance regulation than they generated in revenues in 2020. Collectively, this cohort of jurisdictions raised $2.87 billion in revenue. Net of the $454.4 million they spent on regulation and the $83.5 million they drew in general funds, these states enjoyed a cumulative $2.33 billion windfall from insurance regulation in 2020.

Conclusion

Below, I list the states in order of surplus from insurance regulation (revenues net of both the department’s operating costs and any general funds transferred from the state’s treasury) expressed as a percentage of that state’s departmental budget.

Topics Legislation Profit Loss

Was this article valuable?

Here are more articles you may enjoy.

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears