As we continue to explore niche opportunities in your market, this Lowdown is dedicated to the senior housing arena. I’ve added two reports to Research & Trends to prepare you for your next conversation with senior living operators. According to these reports, operators are facing a number of stresses from both evolving and ongoing risks. Your familiarity with these provide for conversation, whether you are building or maintaining relationships with your prospects and clients.

Beth Mace, Chief Economist for the National Investment Center, dedicated the August 2018 newsletter to a review of the risks facing operators and financiers of senior housing and care properties. In this 3 page brief, you will receive an overview of the things keeping operators awake at night. The more you know, the better the conversation with flow…

The Lowdown on Risks Facing the Senior Living Industry

Evolving Risks:

- Economic Risk – what will a slowing economy bring in 2019?

- Interest Rate Risk – what will an increase in cost of capital have?

- Inflation Risk – how will this impact wage inflation, labor costs, employee retention?

- Supply Risk – is supply exceeding demand in your market?

- Employee Risk – how to attract and retain a quality executive director and senior team? How to manage staff turnover?

- Increases in Acuity – is the operator able to manage the demands of the residents, as frailty and longer life span result in greater demand on staff and services.

- Technology Risk – how is technology safely being integrated into all facets of operation – from sales to managing resident independence?

Ongoing Risks:

- Operator Risk – does the operator have strong systems, policies and procedures in place to ensure safety and compliance?

- Liability Risk – are proper policies and procedures in place to minimize potential for lawsuits?

- Insurance Risk – are best practices in place to control costs and minimize covered losses?

- Credit Risk – are financial practices in place to assess viability of residents to remain in place and meet long term financial obligations?

- Resident Turnover Risk – how is the pipeline for prospective residents maintained?

- Reimbursement Risk – what is the operator’s mix of private pay to public assistance in managing this risk?

- Regulatory Risk – this is a tough risk for any operator to mitigate…

Combine the insights from Beth Mace with those produced by Marcus & Millichap: National Report on Senior Housing, Second Half 2018 and you gain:

Page 2: Demographics driving future senior housing demands – including aging population, decline in home ownership over 75 and shift in wealth into this aging population.

Page 3: Economic and operational challenges – rising health care costs, employment trends.

Pages 4-7: Industry outlook for independent living, assisted living, memory care, continuing care – inventory growth and absorption, occupancy rate trends, rent trends.

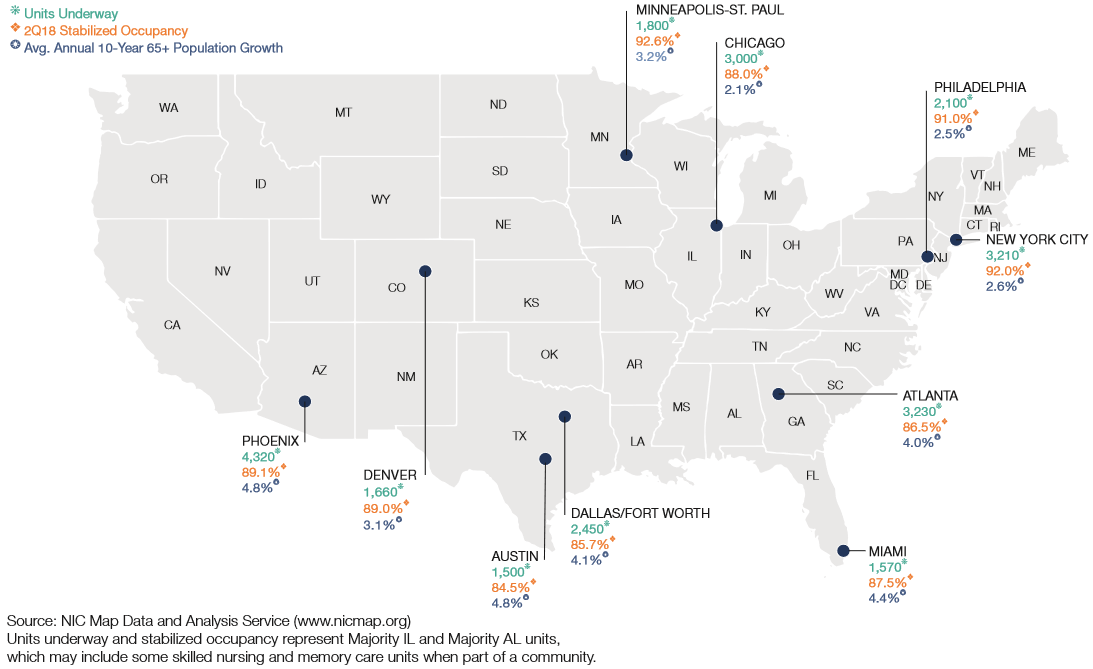

Page 8: Top 10 Senior Housing Construction Markets

Ranked by Units Under Construction:

- Phoenix

- Atlanta

- New York City

- Chicago

- Dallas/Fort Worth

- Philadelphia

- Minneapolis-St. Paul

- Denver

- Miami

- Austin

Though you may not reside in one of the top developing cities for senior housing, it’s a fair bet you have a handful of facilities nearby. While I can’t wholeheartedly recommend a great on-line directory, the SeniorLivingLink.Org offers a zip code driven listing with map overview to get a sense of how extensive your market is. While it may not be all encompassing, it captured my local market quite well.

If you still aren’t sold on exploring niche markets, you can still grab a look at the Vertafore sponsored webinar, Riches In Niches for the month of November. Steve Anderson, the presenter, suggests you learn all you can about your niche. If senior living is not yours, check back often as I’m sure I’ll come across a report addressing your interests eventually! Feel free to email me with your ideas at psimpson@wellsmedia.com and I’ll seek out a report on the topic!

Happy reading – Pam Simpson

Was this article valuable?

Here are more articles you may enjoy.

Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed

Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed  Pipeline Explodes at Delfin LNG Planned Project in Louisiana

Pipeline Explodes at Delfin LNG Planned Project in Louisiana  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call