The typical independent insurance agency owner is a person who spent most of their career in production. At some point, when their book of business was large enough, they either started a new firm or became the new partner in their current agency. Production skills are what most owners have in common.

There will come a time for most owners when they need to at least consider bringing on a new business partner. It might be related to a merger, or perhaps a key producer that is requesting ownership in the agency. So, what is the best way to screen and evaluate potential new owners?

If the role of an owner was treated like any other position in an agency, what would the job description look like and what are the key characteristics to look for in the person to fill the role? The first step is to use all the skills and talents developed when hiring employees to look for a new partner, or a perpetuation candidate.

What roles to perform?

The primary role of an “agency owner” should be handling the strategic management of the firm. Strategic management means the big picture issues such as major decision-making, corporate vision/leadership and agency planning. Of course, the smaller the agency, the more hands on the owner will need to be.

Please keep in mind for this article the term “agency owner” applies to the unique responsibilities associated with ownership and does not include other roles such as production. Often, an owner usually is the largest producer in an agency.

The specific tasks an owner should be responsible for include the strategic management of: administration and operations, financial affairs, automation, market relations, sales, market placement and client service. Some agencies may also have a program business department or a life/benefits department that would also require an owner’s attention. If an agency has more than one owner, these tasks should be split-up.

For most agencies, a lead employee or a manager should handle the day-to-day tasks. For example, the accounting department should prepare all the financial statements and management reports, as well as provide a summary of the results to the owner in charge of financial affairs. The owner needs to only review and analyze the results and report back to the other owners, if any, along with providing any recommendations.

Another area owners sometimes get too involved in is with personnel. The day-to-day issues involving human resources or workloads should be assigned to an office manager, department manager or a lead employee. When it is possible to delegate the day-to-day activities, owners should only be involved with major issues, such as hiring and firing, making sure annual reviews are performed and the overall approach in how the service departments should be set up and how workloads should be distributed.

The requirements

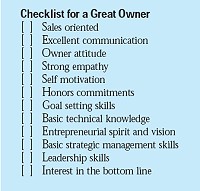

What type of personality, talent and characteristics would a great owner have? The goal of all insurance agencies is to create new sales, service the clients and make a profit. With these common objectives, there are some fundamental characteristics that all owners should have.

A great owner must have a sales oriented personality near the top of their list of qualities. The owner, however, does not always have to be a producer but needs to appreciate production. Without an understanding of the importance of production, that person would have priorities, which could be detrimental to the firm. It must be noted that all great producers make good owners.

In a similar fashion a great owner needs to have a true appreciation for client service. Problems usually arise if the owner focuses on new production and neglects the existing clients and downplays the importance of the service staff.

The last common trait all owners need to have is an entrepreneurial spirit and vision. In other words, the owner needs to act like “an owner,” the person needs to feel responsible that things are running smoothly, new sales are increasing, retention is high, costs are controlled and the agency is moving in the right direction.

For those that start their own agency, this trait usually is fairly strong. This trait may however, be weak in those who move up the ranks in an agency and become an owner because of the size of their book or duration of employment. Those owners that lack this trait become only stockholders in the firm, not active owners in the broad sense of the meaning. They seem to retain an “employee mentality.”

A “great owner” is a person who is well-rounded, having great life experience. Knowledge of a variety of aspects of the industry will only enhance one’s management skills. Communication skills must be excellent and leadership traits must be present. Keep in mind, most owners have had no leadership or management training. Many of the specific skills an owner needs can be learned on the job.

The “great owner” will have at least a framework of these characteristics. The rest can be filled in over time.

How to replace an owner today?

When an owner is hoping to retire today and needs to be replaced, it may take two or three people to replace the role, skills and knowledge base of the retiring principal. There are good administrators and there are good producers, but rarely is someone cut out to do a great job at both.

The world of running an insurance agency is much more difficult today. Not only do insurance companies demand more from the agency, (more underwriting, more professionalism, etc.), but so do employees. Employees are quick to leave if they do not feel satisfied, appreciated and may often feel “deadened.”

Turnover is much greater than it used to be. As firms grow, a person handling human resource issues is often needed and overseen by one of the owners. An understanding of all the rules and regulations today and how to maintain compliance with these new and evolving laws is imperative. Wrongful termination and sexual harassment suits are commonplace and many firms buy EPLI to protect themselves for defense of such allegations and suits.

Who fits the role?

Since management involves such a wide variety of issues, it is difficult to find one person to fit all the roles perfectly. Agencies that have more than one owner have the advantage of splitting up the roles or periodically rotating them to allow some variety in who runs or manages what.

Most owners feel comfortable in dealing with the markets, since they usually have been doing it already. Some of the least favorite areas for owners are financial management and human resources, probably because of the lack of experience in these areas. “Great owners” however, are willing to take on all roles, and when necessary, educate themselves to improve their skills.

Agencies that are looking for a perpetuation candidate, an acquisition/merger prospect or just evaluating an employee as a new owner should follow the typical hiring process. Know what the agency’s expectations and needs are. Create a list of characteristics that are required of that person. Interview the prospect and see if they meet the established criteria. Failure to meet the agency’s “must have” criteria should be an automatic exclusion from ownership.

Reward good producers with deferred commissions or ownership in their book instead. If they prove themselves to have management and owner potential later on, deferred compensation or vested interest in their own produced books of business can be used to offset the cost of the stock.

Reviewing the issues outlined in this article will provide insight into the “big picture” of this matter. The key is to understand all the options, think long-term and keep a clear head.

Bill Schoeffler and Catherine Oak are partners at Oak & Associates. They can be reached at (707) 935-6565, or visit

www.oakandassociates.com.

Was this article valuable?

Here are more articles you may enjoy.

GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half

GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half  Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’

Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’  The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets  Zurich Reveals Beazley Stake After UK Insurer Spurns Bid

Zurich Reveals Beazley Stake After UK Insurer Spurns Bid