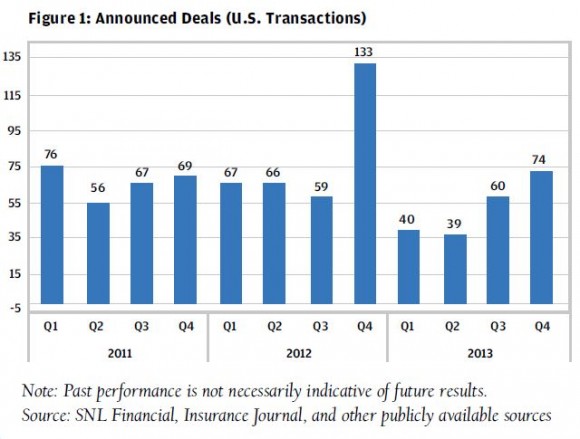

While deal flow was calm for most of the year, fourth quarter merger and acquisition (M&A) activity was lively and momentum was strong going into 2014. With 74 transactions announced in the last three months of 2013, total announced deal volume reached 213 for the year [Figure 1].

November and December dominated the year with 25 and 35 deals, respectively. While activity was down 112 deals compared to last year, acquisitions were more focused in terms of niche or geographic area.

After coming off a record-breaking 2012 marked by uncharacteristically high activity due to the impending capital gains tax rate increase, buyers spent much of this past year refilling their pipelines. To put it in perspective, more deals were announced in December 2012 than the whole fourth quarter of 2013.

With little impetus to get deals done by the end of 2013, some deals were pushed into January. Although activity for 2013 declined to a four year low, deal hangover in the new year points to a strong start to 2014.

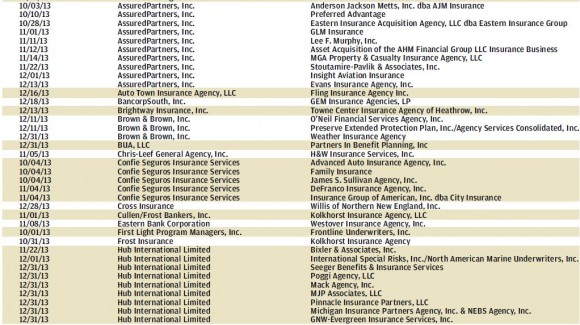

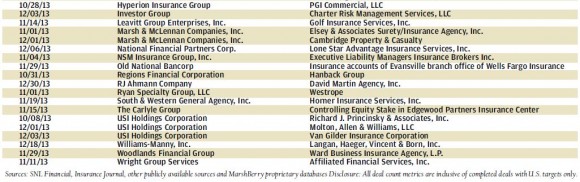

AssuredPartners Inc. completed 11 deals from October to December, making it the most active buyer in the fourth quarter. With a total of 20 deals in 2013, AssuredPartners is also the most active buyer of the year. Since its founding in March 2011, the firm has completed more than 50 acquisitions and grown to approximately $290 million in annual revenue.

Hub International (Hub) completed nine U.S.-based deals in the fourth quarter, raising its annual total to 15 deals. Also continuing to expand its footprint beyond the United States, Hub completed 10 deals in Canada, bringing its total North American deal count to 25.

Arthur J. Gallagher (AJG) completed nine U.S.-based deals in the fourth quarter, finishing the year with 14 deals. AJG has operations in 23 countries and continued its international acquisition strategy in 2013, completing five deals across the U.K., Canada, and Norway.

Confie Seguros continued to expand its portfolio of regional auto insurance brokerages with 14 deals in 2013, five of which closed in the fourth quarter. Since being established in 2008, Confie Seguros has acquired 49 agencies and grown to nearly $300 million in annual revenue.

Digital Insurance rounded out the top five buyers in 2013 with a total of nine deals completed during the year, one more than the previous year.

Private Equity Buyers

Interest among private equity buyers remained strong as the segment continued to dominate with 32 percent of fourth quarter deals and approximately 35 percent of the total count.

Public brokers picked up the pace in the fourth quarter and comprised 13 percent of the buyer pool for the year, although down from 22 percent last year.

In 2013 there were 14 buyers that completed at least two acquisitions, accounting for over half of the total deal count.

Among the sellers, property/casualty firms represented the biggest segment, accounting for 42 percent of total deals for the year.

Approximately 24 percent of all sellers were employee benefits firms and 34 percent were multi-line firms – property/casualty and employee benefits agencies.

Consolidation in the wholesale market continued with activity increasing to 16 percent of all deals for the year, up from 11 percent in 2012.

While 2013 did not break any records, momentum appears to be building and carrying into 2014. We believe that a decrease in economic volatility, abundance of buyers, and excess capital should keep demand high and valuations attractive to quality sellers.

Securities offered through MarshBerry Capital, Inc., Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, Inc. 4420 Sherwin Road, Willoughby, Ohio 44094 (440.354.3230). Except where otherwise indicated, the information provided is based on matters as they exist as of the date of preparation. Past performance is not necessarily indicative of future results.

Topics USA

Was this article valuable?

Here are more articles you may enjoy.

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer  Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme

Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed

Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed