Total Agency Performance

Growth and profit are two of the most important components of agency performance, but even high growth or high margin businesses can become low-performers without looking at the big picture. For example, if a firm is growing the top line rapidly but has not built effective financial controls, the bottom-line suffers creating a low-valued firm.

On the flip side, a high-margin firm that distributes 100 percent of profits to owners without retaining earnings can create balance sheet problems.

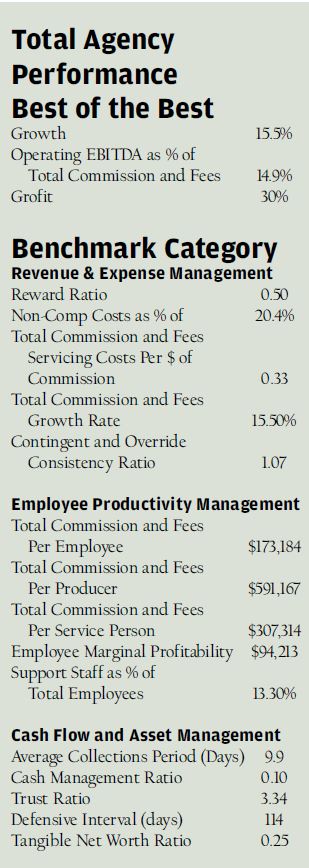

Gauging total agency performance should include a valuation consideration, employee productivity measurement and sustainability assessment based on the firm’s financial position. To gauge total agency performance, an agency needs to excel in three specific areas:

Revenue and Expense Management: To drive value, an agency must produce profitability, growth and expense control. Traditional indicators of performance in this area include growth and profitability. Other key performance indicators in this area include consistency in supplemental income, servicing costs and owner/executive reward.

Employee Productivity Management: Total agency performance should include employee productivity numbers that allow agency executives and leaders to benchmark efficiency by department and by role.

Cash Flow and Asset Management: Independently held firms will need to build an adequate balance sheet for a variety of reasons, but mostly because firms committed to remaining independent will typically cash flow the transition through agency financing, which can strain the agency’s financial position. Those firms that distribute 100 percent of earnings to shareholders need to understand the importance of building a balance sheet and managing receivables accordingly.

Where do you stack up against the most balanced agencies in the business?

Was this article valuable?

Here are more articles you may enjoy.

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio

Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio  Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Lawyer for Prominent Texas Law Firm Among Victims ID’d in Maine Plane Crash

Lawyer for Prominent Texas Law Firm Among Victims ID’d in Maine Plane Crash