Demotech’s review of second quarter 2014 data, as recently reported by insurers to the National Association of Insurance Commissioners, shows that workers’ compensation insurers reported a 5.1 percent increase in direct written premiums during the first six months of 2014 from the same period in 2013.

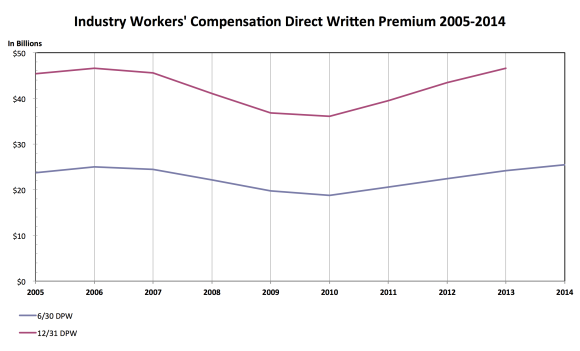

Workers’ compensation direct written premiums have now grown for four straight years. This growth has been driven mainly by rate increases and other insurer pricing actions, in addition to moderate payroll growth from the economic recovery. Written premiums at mid-year 2014 of $25.4 billion have recovered from the 2010 low of $18.8 billion, and have finally surpassed the 2006 prior high of $25.0 billion.

The top 25 workers’ compensation insurers, ranked by the highest dollar amount of direct written premium growth, reported a 27.2 percent increase during the first six months of 2014 versus the same period in 2013. This increase is impressive because 11 of the insurers in this year’s top 25 group were also in last year’s top 25 group. All other insurers combined reported a decrease of 1.1 percent.

AmTrust Financial Services continues its pattern of growth, with four of its insurers among the top 25. In a recent conference call, AmTrust attributed its growth to successfully targeting low-hazard, small-business accounts in key states and to renewing selected business formerly written by Tower Group companies.

The top 25 includes two State Specialists.

New Jersey Manufacturers Insurance Co., in its 2013 management’s discussion and analysis filing, anticipated premium growth in 2014 from a rate increase and the deployment of a new policy administration system that accelerates written premium recognition.

Texas Mutual Insurance Co., in its filing, noted growth in payrolls, competitive pricing, customer service and its strong track record of paying policyholder dividends as factors for its continued premium growth.

Three of the top 25 wrote more than 80 percent of their total workers’ compensation premium in California: Security National Insurance Co., Insurance Co. of the West and California Insurance Co. The recent pure premium rate filing by the Workers Compensation Insurance Rating Bureau of California notes that underlying costs continue to increase faster than payroll growth, even after the enactment of reforms in 2012. Insurers are expected to closely monitor their rate adequacy as they discover the actual impact of the reforms.

Most of the other top 25 are National or Near National insurers that are members of large insurance groups. The growth reported by these insurers may have benefited from the rate increases filed in various states in the past year.

Medical costs continue to represent a majority of workers’ compensation losses. The impact of the Affordable Care Act on future health care system costs remains uncertain. Escalating prescription drug costs, aging of the workforce and obesity-related comorbidities could result in new or increased medical claim costs.

Interest rates continue to be at historically low levels, which results in less investment income to offset some of the cost increases. In addition, interest rates are expected to rise in 2015, which would reduce the value of the long-term fixed income investments traditionally used for workers’ compensation reserves.

Premium is often described as the trading of a small, certain loss for a large, uncertain loss. The top 25 insurers will not know for many decades whether this growth has been profitable or costly.

Topics Trends California Carriers Workers' Compensation Talent Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud

Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud  Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’

Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Florida Senate President Says No Major Insurance Changes This Year

Florida Senate President Says No Major Insurance Changes This Year