Revenue per employee has historically been the measuring stick for staffing and employee efficiency within independent insurance agencies. The industry average revenue per employee continues to show improvement.

But, before you get done patting yourself on the back for improving efficiency, consider the following:

- The number of accounts per employee is also a powerful statistic. Because of improvement in the property and casualty rate environment, agencies are growing without adding a significant number of net new accounts. Typically, servicing work is fairly consistent for accounts as they renew, regardless of whether commission revenue on the account increases or decreases. Before adding another employee to balance workload, make sure the workload has actually increased.

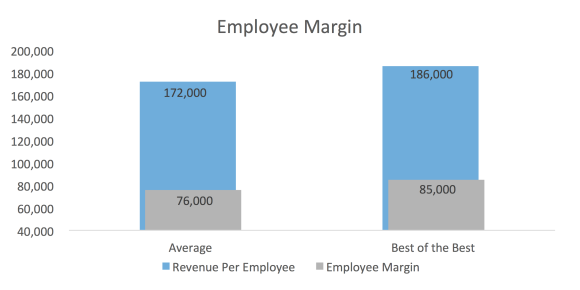

- Are your employees an asset or an expense? Employee margin matters. If your revenue per employee is above average at $175,000, but your payroll per employee is $175,000 (total payroll divided by number of employees), the employee productivity and efficiency becomes irrelevant. The business has profitability issues. It is important to track revenue per employee in line with payroll per employee to ensure that your strong efficiency relates directly to improved profitability. The best firms in the industry pay their employees more, while improving the individual employee margin. Much like a quality acquisition, adding payroll expenses should be accretive to long-term value.

How do you stack up against the most productive firms in the industry?

The best firms in the industry pay their employees more, while improving the individual employee margin.

Was this article valuable?

Here are more articles you may enjoy.

QBE to Non-Renew $500M of North American Mid-Market Biz

QBE to Non-Renew $500M of North American Mid-Market Biz  As Rates Rise, Majority of Homeowners Say Insurance Industry Is in Crisis: Survey

As Rates Rise, Majority of Homeowners Say Insurance Industry Is in Crisis: Survey  Three Charged With Helping Agents Cheat on Florida Insurance License Exams

Three Charged With Helping Agents Cheat on Florida Insurance License Exams  German Insurtech Wefox to Replace CEO After Board Rejects Mubadala Sales Plan

German Insurtech Wefox to Replace CEO After Board Rejects Mubadala Sales Plan