Commanding the Highest Purchase Price

The dust has settled from 2014 and, next to 2012, produced the highest number of deals completed in insurance agency merger and acquisition deal count since MarshBerry began tracking. While the demand for high-quality organizations has not diminished, supply appears to be falling off. We are seeing that agencies with consistent organic growth, sustainable profitability and youth in management that want to sell externally, are becoming an endangered species.

Those kinds of agencies considered “high-quality” would generally be characterized by younger, vibrant leadership, a strong track record of producing new business, a focus in niches that enable scalable growth, compensation structures in line with the market and a base of operations in an attractive area with significant population density. This is not necessarily the average agency.

These firms, generally termed “platform” agencies, are what we consider “the best of the best.”

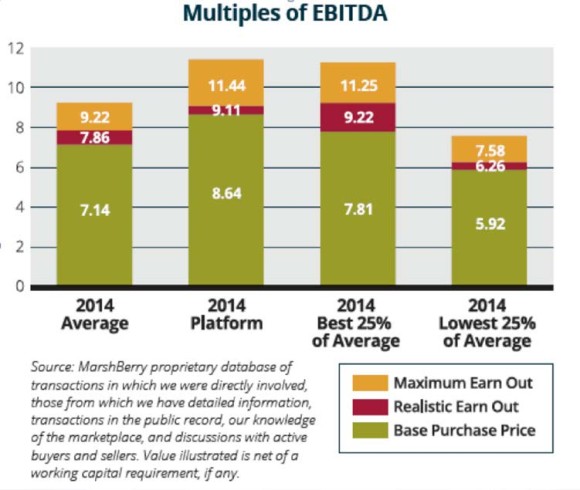

In 2014, “the best of the best” sold for approximately 8.64 times the base purchase price with an earn-out opportunity to increase the purchase price up to 11.44 times earnings before interest, taxes, depreciation and amortization (EBITDA).

Contrast this to the average performance of 7.14 times EBITDA base purchase price and up to 9.22 times with the maximum earn-out (which we are seeing often requires growth in excess of 15 percent to 20 percent per year during earn-out).

As the supply of the best agencies continues to diminish, demand may force purchase prices even higher. Our research indicates that 2015 will be another active market, but any dramatic increase in interest rates is likely to have an immediate impact on the transaction pricing and structures.

Securities offered through MarshBerry Capital Inc., Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co. Inc. 28601 Chagrin Blvd., Suite 400, Woodmere, Ohio 44122 (440-354-3230). Except where otherwise indicated, the information provided is based on matters as they exist as of the date of preparation. Past performance is not necessarily indicative of future results, and individual results may vary. Multiples are averages and do not imply that all deals fall within these parameters.

Was this article valuable?

Here are more articles you may enjoy.

Florida Senate President Says No Major Insurance Changes This Year

Florida Senate President Says No Major Insurance Changes This Year  Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’

Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid