The U.S. workers’ compensation market saw solid gains in 2014, thanks in part to premium increases and favorable claims frequency. This was the fourth consecutive year in which the industry reported improved results, A.M. Best said in a report.

The U.S. workers’ comp combined ratio came in at 101.5 for 2014, reflecting steady improvement compared to the 118.1 combined ratio generated in 2010, according to the report. Net premiums written were $46.8 billion for the sector in 2014, a steady climb from the $34 billion produced in 2010.

A.M. Best said the positives are near-term: “While the industry’s underwriting performance benefits from an overall positive rate environment in 2014, competitive market conditions and persistent low investment yields continue to compress operating margins. Improved fundamentals in recent years appear to indicate that further improvement in results may continue over the near term, given growth in premiums from rate increases and favorable claims frequency relative to claims severity.”

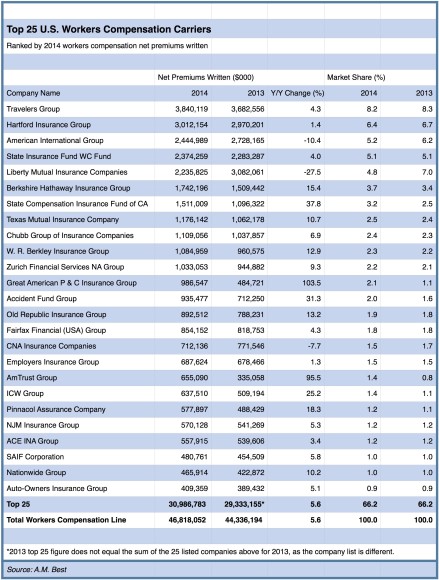

Several giants saw market share shifts in 2014.

Liberty Mutual Insurance’s U.S. workers’ comp net premiums written for 2014 dropped 27.5 percent compared to the previous year, knocking it from second to fifth place in the new A.M. Best special report on the sector’s overall performance.

The insurer produced $2.2 billion in net premiums written during 2014, giving it a 4.8 percent share of the U.S. workers’ comp market compared to $3 billion and 7 percent market share in 2013.

Liberty Mutual said the drop is part of its strategy to rid itself of weak accounts. “Over the past several years, Liberty Mutual Insurance has strategically reduced its exposure to workers’ compensation by targeting under-performing accounts that were contributing to unacceptable results,” the company told Carrier Management. “As a leading provider of commercial insurance today, we continue to be a strong market for workers’ compensation insurance where our claims and loss prevention expertise and customer service focus provide value and superior outcomes to our customers.”

American International Group booked $2.4 billion in net premiums written during 2014 for a 5.2 percent share and third place, a 10.4 percent drop from what it achieved in 2013 when it produced more than $2.7 billion in net premiums written for a 6.2 percent market share and fourth place.

Travelers Group had $3.8 billion in net premiums written during 2014 and 8.2 percent of the market, 4.3 percent higher than the $3.68 billion in net premiums written during 2013 and 8.3 percent market share.

Hartford Insurance Group had $3 billion in net premiums written during 2014 for a 6.4 percent share of the market – 1.4 percent higher than the $2.97 billion generated in 2013, when it had 6.7 percent of the market and was in third place.

This is an edited version of an article published by CarrierManagement.com.

Was this article valuable?

Here are more articles you may enjoy.

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme

Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme  Lawyer for Prominent Texas Law Firm Among Victims ID’d in Maine Plane Crash

Lawyer for Prominent Texas Law Firm Among Victims ID’d in Maine Plane Crash  Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer