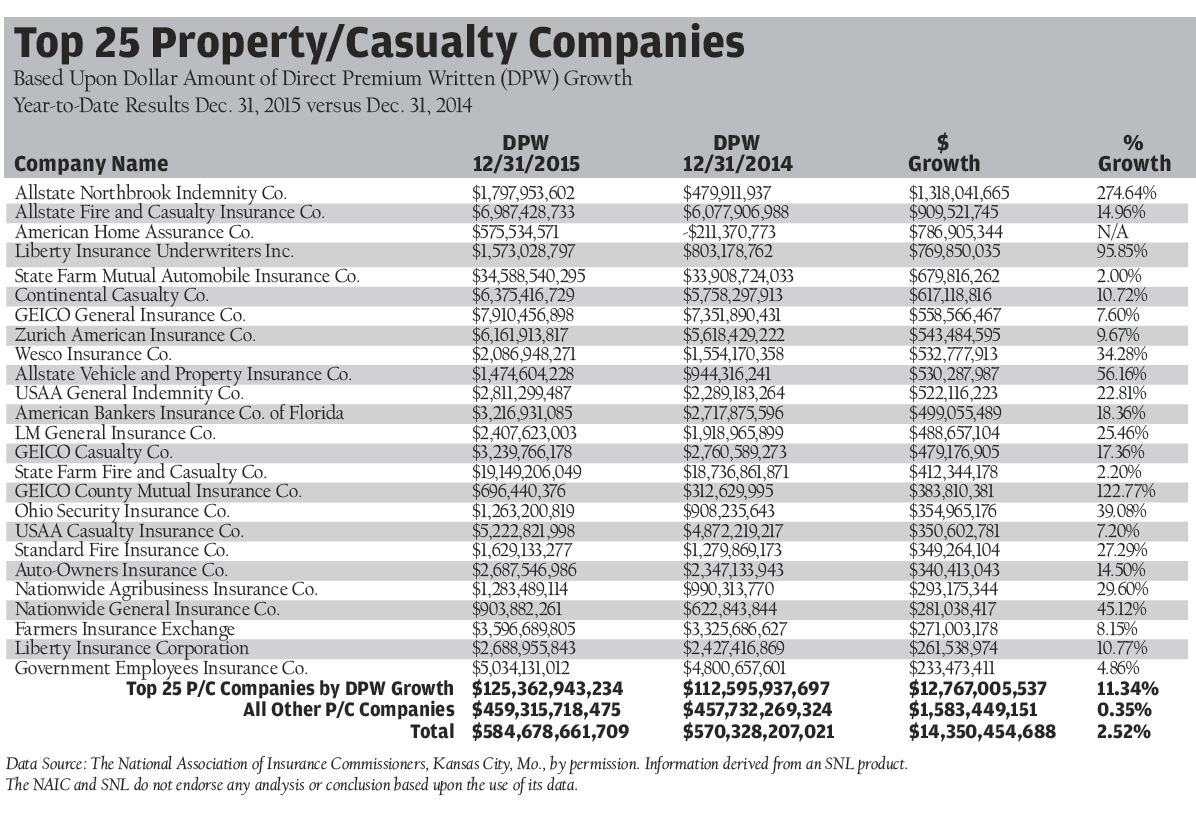

Direct premium written (DPW) for property/casualty (P/C) insurance companies continues to increase, albeit gradually. At year-end 2014, more than $570 billion of DPW was reported. For 2015, total DPW for all P/C insurers aggregately increased 2.5 percent over 2014, an increase of $14.4 billion.

Nearly 90 percent of this premium growth is attributed to the top 25 P/C insurers in terms of growth.

For the 12 months ending Dec. 31, 2015, P/C companies comprising the top 25 insurers leveraged their experience and increased their DPW 11.3 percent over 2014, or $12.8 billion. This continues the top 25 insurers’ impressive display of premium growth and financial stability. In contrast, the remainder of the industry reported an increase in DPW of less than 1 percent, or $1.6 billion, year-over-year.

It is important to note that while increasing DPW, P/C companies have aggregately maintained a sufficient level of policyholders’ surplus (PHS). One measure that indicates P/C companies are conservatively leveraged is the DPW to PHS ratio. An insurer’s DPW to PHS ratio is indicative of its premium leverage on a direct basis, without considering the effect of reinsurance. Since 2010, this ratio for P/C companies has remained stable at approximately 70 percent.

Although the market continues to exhibit signs of firming and DPW continues to increase, P/C insurers should not expect a traditional hard market in the near future. More importantly, it is possible that the double-digit premium growth experienced in the historical hard market cycles may have created unrealistic premium growth expectations for this current recovery.

It is more realistic that expectations should relate to gradual, stable growth.

If the industry continues to hold to its 10-year historical pattern, growth in 2016 would again result in the highest level of year-end DPW ever reported by the P/C industry.

Topics Trends Carriers Pricing Trends Property Casualty Market

Was this article valuable?

Here are more articles you may enjoy.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets  Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh

Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears