The workers’ compensation insurance markets in South Central states are relatively stable and are experiencing a drop in rates across the board. However, reforms made in Oklahoma in 2013 continue to be challenged in court and medical costs remain a concern in all states.

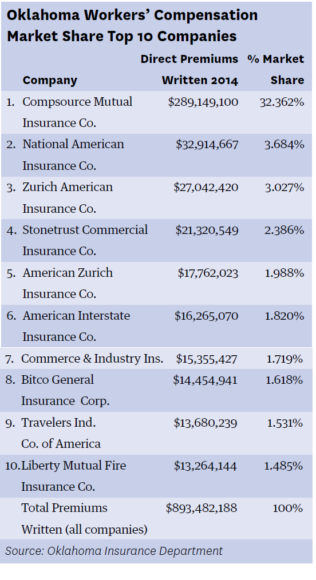

Oklahoma: Costs Drop, Reforms Tested

Workers’ compensation costs dropped in Oklahoma in the aftermath of comprehensive reforms enacted in 2013, but the changes have suffered legal setbacks this year. In February, the Oklahoma Workers’ Compensation Commission found to be unconstitutional the Oklahoma Employee Injury Benefit Act (or Oklahoma Option), saying injured workers are not treated equally under the dual system.

The 2013 Oklahoma Workers’ Compensation Act took another hit in early March when the state’s Supreme Court ruled against the provision prohibiting claims from injured workers who have been employed less than 180 days. The Court also struck down the part of the law that authorizes deferral of payments for permanent partial disability for workers who eventually return to their jobs.

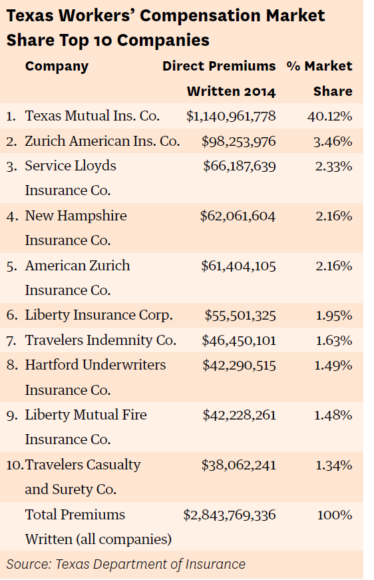

Texas: Lower than Typical Costs per Claim

In a comparison study of 17 states, the Workers’ Compensation Research Institute (WCRI) found that Texas experienced a rate of growth in costs per claim and components similar to or less than that in many of the other study states from 2009 to 2014. Texas costs per claim were lower than typical throughout the study period, but where growth in claims costs occurred it was attributed to medical costs.

However, the WCRI found little change in medical costs in Texas from 2013 to 2014 due to stability in nonhospital prices and continued decline in utilization of nonhospital services.

Texas allows employers to opt out, or nonsubscribe, to the workers’ comp system, but requires those employers to report their non-coverage status. Because nonsubscription reporting is historically low, the state extended the reporting period this year to increase compliance.

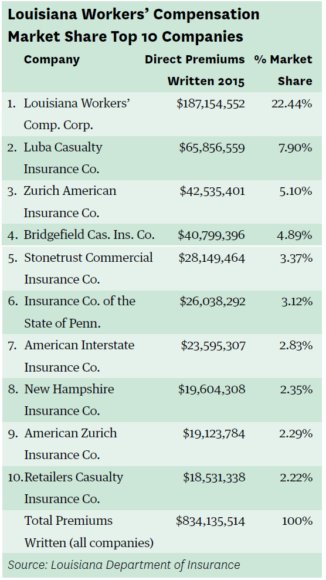

Louisiana: More Companies, Lower Rates

In a February 2016 newsletter, Louisiana Insurance Commissioner Jim Donelon said rates in the workers’ compensation market have declined 51 percent since 1996. The commissioner noted that there are 235 companies writing workers’ comp in Louisiana today, compared with 197 companies in 2007. Donelon approved a 2.7 percent rate reduction that was effective May 1, 2016.

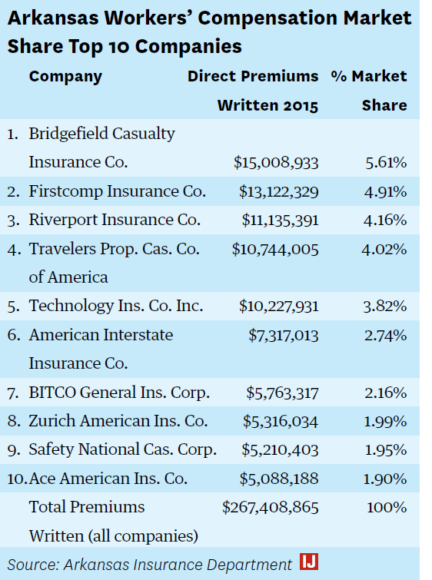

Arkansas: Market Stable but Medical Costs Rising

The overall loss cost in the voluntary workers’ comp market in Arkansas will decline by 4.3 percent and the overall average assigned risk will decrease by 1.6 percent on July 1.

In a report on the 2015 Arkansas workers’ comp market, the National Council on Compensation Insurance (NCCI) said premium volume and indemnity are stable but that medical costs continue to rise. Medical costs in Arkansas represent 68 percent of the total benefit cost compared with an average 41 percent nationwide, according to NCCI.

Was this article valuable?

Here are more articles you may enjoy.

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer  GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half

GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half  Winter Storm Fern to Cause Up to $6.7B in Insured Losses

Winter Storm Fern to Cause Up to $6.7B in Insured Losses  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call