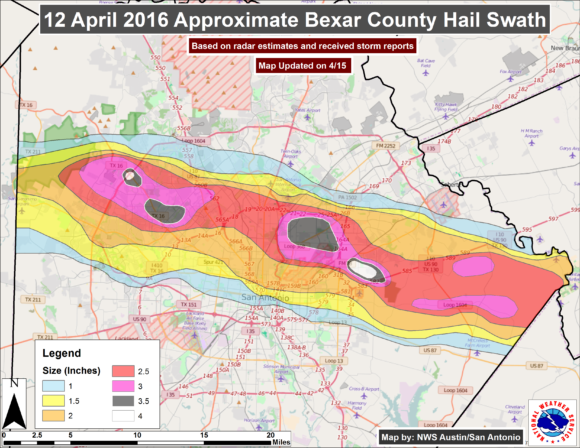

A hailstorm that covered a swath of nearly 70 miles hit the San Antonio area on April 12 and is estimated to become the costliest such storm in Texas history, an insurer trade group says.

The storm was concentrated in the North San Antonio/Bexar County areas. The Associated Press reported that hail the size of grapefruits was recorded near Helotes. More than 110,000 vehicles and thousands of homes were damaged, according to the Insurance Council of Texas.

The evening storm damaged roofs and knocked holes through car windows. The National Weather Service verified reports of 4.5-inch hail, and said the event is now tied for the largest hail size recorded in Bexar County since accurate records began in 1950.

“The storm primarily struck the northwestern portion of Bexar County moving across northern areas of San Antonio with large hail that was shaped like jagged rocks,” said Robert Crosby, executive director of the Independent Insurance Agents of San Antonio.

Estimated insured losses to vehicles are expected to reach $560 million while damage to homes and businesses is expected to reach $800 million, the ICT reported.

The $1.36 billion total surpasses the May 5, 1995, hailstorm that struck Fort Worth causing an estimated $1.1 billion in damage.

Uninsured losses from homeowners without residential property insurance and vehicle owners without comprehensive insurance are also expected to be high.

Q1 Texas Cat Losses

The Travelers Companies Inc. reported that its performance in the first quarter of 2016 was negatively impacted by higher catastrophe losses mainly arising out of hail storms that occurred in Texas in late March.

The company reported net income of $691 million for the quarter ended March 31, 2016, down 17 percent from $833 million in the prior year quarter. Operating income in the current quarter was $698 million compared to $827 million in the prior year quarter. Travelers said the declines are primarily due to Texas cat losses.

At press time, Allstate had not reported its overall results for the first quarter but estimated cat losses in the first quarter from 17 events to be $830 million, with about $638 million of that in March.

Two severe hail events, primarily impacting Texas in March, accounted for two-thirds of the company’s catastrophe losses for the quarter, according Allstate.

The larger of the two storms occurred on March 23 and extended from Texas to Florida. It produced violent thunderstorms with 2.5-inch hail and 65 mph winds in Texas, and 1-inch hail and similar winds in Florida.

The smaller of the two events occurred during morning rush hour on March 17 and produced hail as large as 2.75 inches in Texas and 1.75 inches as it moved east into Louisiana.

The cities of Fort Worth and Arlington saw the greatest amount of damage from that storm.

Allstate’s claim volume has been heaviest in Collin, Dallas and Tarrant counties where the Allstate brand has estimated market share greater than its statewide average, according to the carrier.

Farmers Insurance reported that it expects claims from the two severe weather systems in the Dallas/Fort Worth area in March will result in more than $250 million in losses for the company.

Farmers said more than 22,000 claims had been filed as of April 5 and it anticipated another 16,000 claims resulting from the two March storms in North Texas.

Was this article valuable?

Here are more articles you may enjoy.

Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion

Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion  Charges Dropped Against ‘Poster Boy’ Florida Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Florida Contractor Accused of Insurance Fraud  Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals  The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets