Workers’ Compensation Premiums Down 8% in First Half of 2020

Prior to discussing the results of our review of aggregate workers’ compensation insurance written in the U.S. during the first half of 2020 versus the first half of 2019, permit me to offer Demotech’s perspective on the impact of COVID-19 on the insurers comprising the property/casualty and life and health insurance industries.

COVID-19 has been, and may continue to be, solely an earnings event. With more than 4,000 insurers, P/C and life/health, reporting data to the National Association of Insurance Commissioners, the number of carriers whose solvency is threatened by the COVID-19 is immaterial.

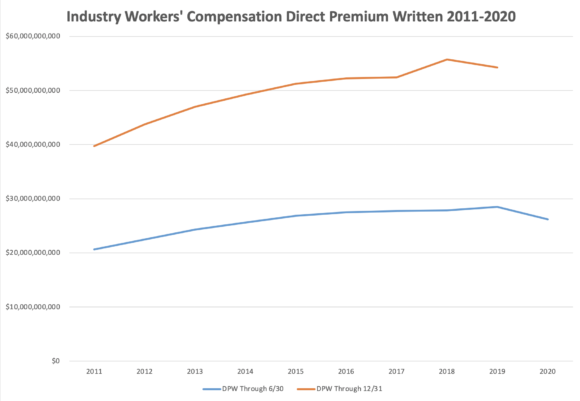

As to direct written premium in workers’ compensation, in the aggregate, our mid-year to mid-year comparison of workers’ compensation direct premium written indicated an overall decrease of approximately 8% was reported in the U.S. for the first six months of 2020 versus the same period in 2019.

Although several members of the Top 25 carriers, those with the largest dollar volume of workers’ compensation business volume, were able to resist that trend a bit, the Top 25 saw a period-to-period direct premium written decrease of 5%. This occurred despite several members of the Top 25 reporting increased direct premium written or holding their own: Zurich American Insurance (0%), Insurance Company of the West (32%), American Zurich Insurance (3%), Old Republic Insurance (0%), ACE American Insurance (12%), Arch Insurance (5%), Indemnity Insurance Company of North America (9%), and National Union Fire Insurance Company of Pittsburgh, PA (13%).

With the Top 25 writers of workers’ compensation outperforming the aggregate sector on retention of direct written premium, the premium written by insurers ranking number 26 through 689 declined by 9.4%.

The dollar decline of workers’ compensation premium volume in the sector from YTD June 30, 2019, to YTD June 30, 2020, was a decrease of nearly $2.3 billion, or 8% overall.

Putting this situation in perspective, direct written premiums reported at mid-year 2019 were nearly $28.5 billion, an all-time high for a mid-year report. To get additional perspective on the growth that led to that record in June 2019, the dollar amount of direct written premium on June 30, 2010, was $18.8 billion. Yet, based upon our review of second quarter 2020 data, year-end 2020 workers’ compensation direct written premiums may result in the second consecutive year-end over year-end decline.

Clearly, with a premium base consisting of payroll by classification, growth in workers’ compensation premium volume between the June 30, 2020, report, and the upcoming year-end 2020 report is highly dependent on changes in employment levels. Given the relative impact of COVID-19 by state, in part, year-end 2020 direct premium written will depend on the breadth, depth and scope of the re-openings of the economies in the states that have not yet fully done so.

State by state unemployment results have been and remain dependent on the degree to which economies are re-opening. This should be based upon the degree to which COVID-19 related personal and business restrictions were in place through June 30 yet abated or removed over the period July 1 through Dec. 31.

The influence of several populous states with established centers of finance and commerce will shape the relative workers’ compensation direct premium written level for the second half of 2020. Concurrently, the ability of the larger states that initiated re-openings earlier than other states will shape the final year-end 2020 results for workers’ compensation insurance.

Similarly, the behavior and response of the employers impacted by COVID-19 will continue to shape the recovery of the workers’ compensation insurance sector. Having reduced payrolls, employers have also reduced their cost of worker’s compensation coverage. If the effort of employees who were laid off, terminated or separated is not apparent and is not missed, why would those employers be incentivized to add back the additional payroll and the related cost of the employees’ workers’ compensation insurance?

Concurrently, with travel restrictions in place and interaction with clients and prospects being redefined and working from home a new normal, might employers reclassify personnel from higher cost classes to lower cost classes, thereby reducing the cost of workers’ compensation even though payroll and head count increase.

Although this article has focused on the year-to-year premium volume changes for workers’ compensation, permit me a few random thoughts on other challenges that COVID-19 has created.

Return to work programs and light duty efforts have been impacted, whether those that were in place prior to COVID, and those that might have been put in place had COVID not manifested itself.

Less than six months after experiencing one of the strongest economies in U.S. history, bankruptcy, downsizing and right-sizing are under serious discussion by employers.

COVID’s impact on healthcare providers, i.e., hospitals, employer health plans, Medicaid, Medicare, etc., also impacts patients requiring medical or wage replacement benefits associated with workers’ compensation.

The ultimate impact and influence of “working from home” has not yet been seen.

Vocational training needs to be reconfigured to reflect the “Beyond COVID economy.”

In conclusion, measuring and reporting year-to-year dollar changes in workers’ compensation insurance is an arithmetic exercise. Assessing the impact of the emergence of the one in 100- year pandemic known as COVID-19 on workers’ compensation insurance will be directly correlated with the changes that COVID-19 has on employment, payrolls and employers.

Stakeholders should be comforted that the insurance industry, due to the statutory accounting principles enforced by regulators, is uniquely positioned to respond to the impact of COVID-19, known or unknown.

I state again: COVID is an earnings event, not a solvency event.

Topics USA Carriers Workers' Compensation

Was this article valuable?

Here are more articles you may enjoy.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Lawyer for Prominent Texas Law Firm Among Victims ID’d in Maine Plane Crash

Lawyer for Prominent Texas Law Firm Among Victims ID’d in Maine Plane Crash