The recent upticks in the frequency and severity of weather events has affected insurance premiums for rental properties. According to S&P Global Ratings, insurance is an increasing percentage of total expenses for rental properties and the trend is expected to persist.

The weighted average for property insurance was about $590.30 in 2022, compared with about $473.60 the year before and about $386.90 in 2020.

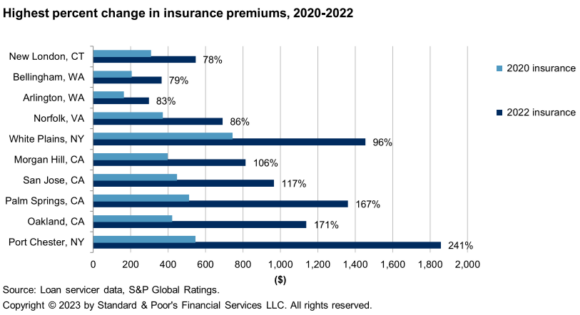

S&P Global Ratings analyzed 2020-2022 expense trends on 60 loans on U.S. affordable housing properties receiving low-income housing tax credits. The properties contain over 6,500 units.

“We expect property and casualty insurance premiums for commercial properties, including multifamily, will keep rising through 2023,” S&P Global Ratings said.

Properties with the largest increases in insurance expenses are located in the following markets:

Topics Trends

Was this article valuable?

Here are more articles you may enjoy.

Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme

Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme  The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call  Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio

Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio