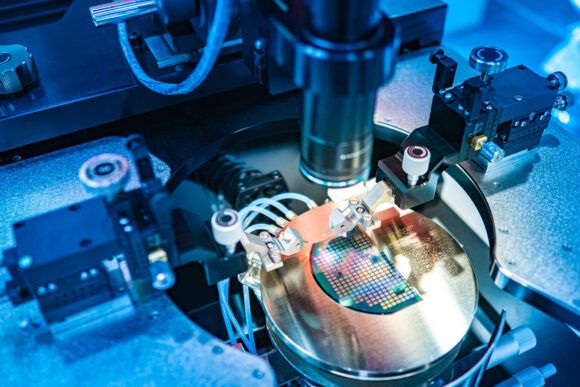

Demand for technology-related products such as computer chips, semiconductors, electric vehicle batteries and embedded software is rapidly increasing in today’s tech-driven society, which is in turn increasing demand — and opportunities — for manufacturers.

But as manufacturers strive to meet the growing demands of an evolving technology sector, many don’t understand the professional liability exposures that can arise during the manufacturing process and are failing to protect themselves as a result. Agents and brokers are perfectly positioned to help safeguard companies from potential liabilities and build their books of business in the dynamic technology manufacturing landscape.

Drivers of Growth

The federal Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors and Science Act (CHIPS) and the Inflation Reduction Act (IRA), have fueled unprecedented growth in the overall manufacturing industry, according to Deloitte’s 2024 Manufacturing Industry Outlook, with technology manufacturing way ahead of the pack. Investments in semiconductor and clean technology manufacturing had nearly double the commitments in 2021, close to 20 times what was allocated in 2019, Deloitte said. Additionally, Deloitte noted that an estimated 200 new clean technology manufacturing facilities were announced since the IRA passed in 2022, representing an investment of about $88 billion.

It’s not surprising that manufacturers are looking to increase the speed with which new products are created and the efficiency of their product delivery. In a recent survey of manufacturing companies published by Forbes, 55% of respondents said that “improving manufacturing and supply chain visibility” is a top business priority, and 78% are “evaluating technologies that will help increase operational efficiency.”

Protecting the Bottom Line

As manufacturers look to take advantage of new opportunities and improve operational efficiencies, it is easy for them to overlook the many exposures that can come along. Most manufacturers understand physical risks like property damage or bodily injury and take steps to reduce that risk with proper insurance policies. However, some are much less familiar with the professional exposure they face from negligence that can result in defective products, design flaws or lack of quality control. That’s where manufacturers errors and omissions (E&O) coverage comes in. It can protect companies from third-party financial losses and related litigation from an alleged product or work defect.

A few typical claims scenarios where manufacturers E&O coverage could apply include:

- Repetitive errors, where the wrong item is produced in mass.

- Mistakes in the design process that lead to the wrong item being manufactured or an item being manufactured incorrectly.

- Product labeling issues, for example, when information about the product is omitted or misstated on the packaging or on the product itself.

- Delays in the manufacturing or delivery process that cause delays to projects relying on that product or part.

Manufacturers E&O claims tend to be driven by severity rather than frequency, averaging about six figures. Because many technology products being created are so specialized, they may be produced by smaller manufacturers that would be devastated by a large claim, particularly if there is any reputational damage.

Many manufacturers mistakenly believe they are protected from the costs associated with E&O exposures, including any litigation, by other policies such as product liability or general liability. Manufacturers E&O policies can plug the gap between these coverages but only about one in four manufacturers buy E&O coverage. Of those that do, it may only be because they are required to by contract, so they obtain a limited policy with insufficient limits and coverage gaps.

Agents and brokers who are proactive in learning about the manufacturing segment, the current E&O risks and the overall coverage market will be a valuable resource to their clients in a time of unprecedented industry growth.

Topics Agencies Liability Manufacturing

Was this article valuable?

Here are more articles you may enjoy.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’

Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’  Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed

Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed  Florida Senate President Says No Major Insurance Changes This Year

Florida Senate President Says No Major Insurance Changes This Year