An insurance agency executive’s control of commercial lines growth is classically limited to encouraging producers to write new accounts. That is good of course, but the organic growth experienced by most independent insurance agencies is more dependent on factors outside any agency executive’s control such as rate, risk, exposure and economic change. The single largest driver in agencies experiencing above average growth in commercial lines is that they understand these forces and take a strategic approach to writing new accounts.

When setting growth goals for commercial lines, it is standard practice to review the commercial book looking at customers based on average account size and, in particular, focusing on the proverbial 20 percent of customers that generate 80 percent of revenue. It is also common to use owners’ or producers’ instincts to determine which industry segments have been predominant within the commercial book.

To excel, an agency needs a more deliberate and forward looking approach to growth that strategically evaluates and scores attributes such as customer size, growth, market penetration and the potential growth within that customer’s market segment and geographic footprint. It is there, in the future, that the agency’s growth potential resides, not in the past.

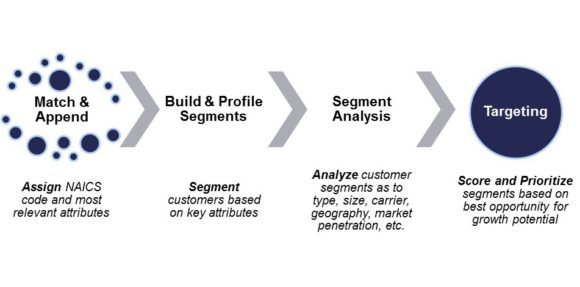

This admittedly complex process isolates and identifies potential industry segments with the best opportunity to increase market penetration. Knowing this, an agency executive can clearly see where to target sales efforts and in what industries; and can therefore design, tailor and implement strategies to generate new business.

This form of analysis is called Business Segmentation.

The Business Segmentation process is a thorough analysis of an agency’s commercial book of business that divides the commercial book into specific subsets, as respects to industry and attributes. From there, the subsets are grouped and analyzed leveraging market data with a focus on account size, current market penetration, industry emergence or decline and of course potential commission in the market area. This segmented analysis better identifies the agency’s best customers, but in new terms.

Best customers of the past may not be in the best industries for the future. What are those industries? What is the agency’s current competitive capability in those industries and which are the best carriers to use? Past success as to industry type, competitive capabilities and growth are important to understand.

What is vital to understand is where to focus resources to secure accelerated growth in the future.

The difference in this type of analysis is:

1. All industry segments are clearly identified; not just those based on one’s instinct.

2. Market data is used to determine market penetration and market share opportunity in the agency’s defined geographic footprint.

The emphasis of Business Segmentation is to grow by writing new accounts. This is needed because the increase in business most agencies experience today is more reflective of what is happening within the economy and market and has less to do with the factors associated with new business, especially for commercial lines. To explore this further, let’s look at the factors that contribute to growth.

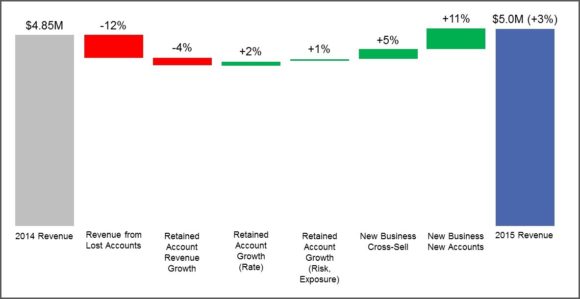

Moving left to right in the “Growth Contributors” chart below, attrition is accounted for first by revenue lost from non-renewed accounts. Next, retention is broken into three factors: revenue growth for retained accounts, growth due to rate and growth due to risk/exposure. These retention factors can be negative or positive depending on the economy and market conditions.

Growth Contributors

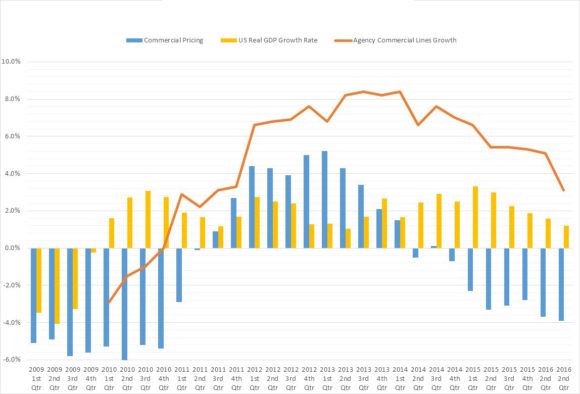

Finally, the last two factors address new business from writing new accounts as well as revenue generated from cross-selling activity, including coverage upgrade or upselling. The growth most agencies experience today is more reflective of what is happening with the three retention factors, not the two new business factors as illustrated in the “Industry & Economic Growth Rates” chart below.

The “Industry & Economic Growth” chart contains the following data for each quarter since Q1 of 2009:

Change in commercial pricing during that quarter – blue bars;

Average organic growth in commercial lines – orange bars;

Real GDP Growth Rate for the U.S. – yellow bars.

The most important takeaway from reviewing this chart is how organic growth in commercial lines for agencies swings with the rise and fall of the U.S. economy and commercial pricing. These outside factors have had more impact on agency growth than organic production over time and within the average agency.

Industry & Economic Growth Rates

After the Great Recession in 2008, commercial lines organic growth was not positive until Q1 of 2011, which can be attributed to the upswing in the overall U.S. economy during 2010 (See Organic Growth vs. U.S. Real GDP Growth chart, page 80). Then, at the start of Q3 in 2011, commercial pricing started to increase, and therefore caused another upswing in organic growth for commercial lines in Q1 of 2012 (See Organic Growth vs. Commercial Pricing chart below). This upswing continued to climb and remained close to that level until Q2 of 2014, where there was a decline in the economy which in turn created a downswing in commercial pricing.

In summary, compiling and forming a plan based on results from Business Segmentation gives an agency executive the ability to be more strategic and focused on writing new business accounts in a deliberate and targeted manner, which therefore makes the agency less susceptible to swings in commercial pricing and the economy. It is a simple choice: When you have no plan, market conditions will make one for you.

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh

Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh  US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI

US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market