Consumers are hearing a lot about insurance difficulties around the country. The news from California and Florida and elsewhere about how disasters, skyrocketing premiums and carrier withdrawals are making coverages hard to find and afford naturally raises concerns in other states.

New Hampshire Insurance Commissioner D.J. Bettencourt wants his state’s residents to know that the story in the Granite State is different and they have little to worry about.

“What I want to stress though to consumers is that things here in New Hampshire are going quite well,” said Bettencourt, who was confirmed as head of the New Hampshire Insurance Department (NHID) a year ago after serving as deputy insurance commissioner since early 2021.

New Hampshire Insurance Commissioner

“We’re not immune to the larger national and, in some cases, international trends that are causing the insurance industry to struggle. But what we want to ensure is that the situation in New Hampshire is being appropriately communicated,” Bettencourt said in an interview with Insurance Journal.

“We don’t want consumers to get the impression that coverages are hard to get these days, or they’re really expensive,” he said. For the vast majority of coverages in New Hampshire, “things are going about as well as possible.”

According to Bankrate, while they have been increasing, car and home insurance costs in the state are still among the lowest in the country on average.

The message that things are going well in New Hampshire is one that Bettencourt wants the insurance industry to hear as well.

“We’re in a lot better shape here in New Hampshire than in other parts of the country to be sure,” he bragged, citing the state’s “high quality of life metrics” and its collaborative rather than adversarial approach to insurance regulation and legislation.

According to Deputy Insurance Commissioner Keith Nyhan, who joined the conversation, the Granite State is benefitting from competition and on the whole is “very insurable” on the property/casualty side. “Our risks compared to the Gulf Coast or California with its wildfires are less severe. Companies want to be in New Hampshire,” said Nyhan, who prior to being promoted to deputy commissioner last October served as director of NHID’s consumer services unit since 2007.

New Hampshire is a small insurance market. It ranks 44th, according to the National Association of Insurance Commissioners (NAIC). It’s a $12.6 billion total insurance market, with $3 billion in property/casualty. The state has about 1,300 insurers for all lines.

According to Bettencourt, its small size informs the state’s approach to insurance regulation. “We’re a small state and at the end of the day, if we become unreasonable in how we approach our regulatory philosophy, those companies will just withdraw from New Hampshire and, financially speaking, it’s not going to make a whole big difference to them,” he said. He added that the state has established a reputation “over many, many years” of being a collaborative and pragmatic regulator.

While there are things like the weather that states can’t control, the “regulatory attitude” is among the things he believes a state can control. “My philosophy is ‘let’s be collaborative, let’s work together’ to fix this problem,” stressed Bettencourt, who was a state legislator before he became a regulator.

Profitability

In its 2022 report card on state insurance regulation, the R Street Institute gave New Hampshire a B grade, the same grade it gave Maine, Vermont, Iowa, Kentucky, Washington and a few others.

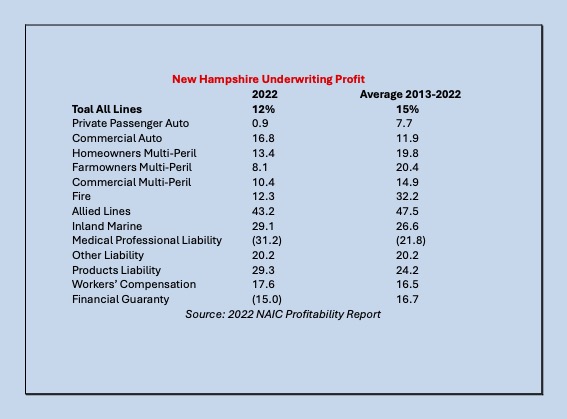

The insurance results also tell a positive story for insurers. According to the NAIC’s 2022 Profitability Report, insurers made a 12% gain on underwriting for all lines in 2022 and have averaged a 15% underwriting profit over the last decade.

All of this is not to say that there are no insurance challenges at all in New Hampshire. There is, in fact, one line of insurance that is a worry: general liability for nonprofits.

This is an “incredibly hard market, and I understand the reasons why,” Bettencourt said, citing the large claims with long tails seen in the sector.

The insurance for nonprofits issue has grown in importance in the context of the state’s continuing efforts to enhance programs for mental health and substance use disorder. The state makes the funding available and then puts the programs out for bid to community organizations to run them. In order to contract with the state, these organizations need to have general liability insurance. NHID has learned that in some cases, small to mid-sized nonprofits are unable to access coverage or afford it.

Bettencourt said NHID is working to address the matter. He said he does not want the state to lose the opportunities to rebuild the healthcare infrastructure to benefit people because it doesn’t have the nonprofit partners to run programs.

Nyhan agreed insurance for nonprofits is a difficult market right now. “It’s a risky business,” he commented, adding that NHID is “actively trying to get more companies to come to the state.”

Consumer Calls

Another matter Bettencourt wants to tackle is customer service— that provided by insurance carriers and by NHID itself.

NHID receives about 6.500 calls from consumers a year. About 500 of the calls will turn into formal complaints against an insurance carrier, according to Nyhan. The vast majority of the calls are from consumers who have a question about their policy or want help interpreting a letter that they received from their insurance carrier.

The most common consumer complaint has to do with frustrations with carriers’ customer service, especially the inability to speak with a human being.

Bettencourt said insurers want insureds to do everything online but many have difficulty navigating the portals and online systems.“So there’s just a lot of frustration in that people can’t get another human being on the phone,” he added.

Overwhelming Technology

Asked if he thinks the industry is relying too much on digital and online service, expecting consumers to be comfortable going digital, Bettencourt didn’t hesitate.

“In my personal opinion, yeah. I mean the technology that’s coming online obviously provides a lot of opportunities. I understand that companies want to take advantage as much as they can, and they’re not wrong for wanting to do that.”

But, he added, “they need to also not forget that there are consumers at the end of the day who need to speak to another live human being. Their particular claim may be complex.”

He urged carriers to remember that in most situations where an insured needs to interact with their insurance carrier, it means something bad has happened. “When people need to file a claim, they’re typically not having their best day. So sometimes the task of going through all of the electronic portals and all of the different technology systems is overwhelming to them. They just want to get somebody on the phone.”

Bettencourt is on a mission to improve his department’s own customer service and what he calls “insurance literacy” among consumers. He believes a key to improving insurance understanding is to “raise awareness of the department’s existence” including what it does and the services it can provide to consumers to help them better understand their insurance, solve a problem or manage a crisis.To accomplish better literacy, NHID is reaching out in different ways. NHID has called upon its consumer division and communication team to emphasize outreach including going out to community events and trade shows, producing podcasts and webinars, creating a new website and beefing up the department’s social media presence.

“We’re trying to figure out how we can meet the consumer where they are and where they are on these new alternative ways of getting news, social media, podcasts, webinars. We’re trying to adapt along with the times because we cannot help the consumer that doesn’t know that we exist,” Bettencourt explained.

He said NHID’s consumer protection job includes going out into the community to meet consumers, initiate conversations, and distribute advisories.

NHID held a March symposium on property/casualty insurance cost drivers featuring Dr. Robert Hartwig, professor of finance at the University of South Carolina; Lee T. Dowgiewicz, CEO of Co-operative Insurance Companies; attorney George Roussos of Orr & Reno; and Christian Citarella, chief property/casualty actuary at the NHID.

The department has convened town halls including one with behavioral health providers to enhance NHID’s own understanding of their concerns. It has sponsored legislative updates for the public and press. Its webinars have touched on various subjects from how to prepare for potential weather disasters to what to know about wedding insurance. NHID also participated in an event warning about reckless driving that was held at the New Hampshire Motor Speedway in Loudon.

Cat Response Team

The most recent initiative is a dedicated intergovernmental Weather Catastrophe Response Team, which the department sees as a proactive, coordinated, department-wide effort to support consumers in the aftermath of severe weather incidents. This team is tasked with organizing community outreach events in affected areas and collaborating with other state and federal agencies and officials to provide comprehensive support to consumers. The goal is to ensure that residents receive accurate information and timely assistance.

New Hampshire is not he most disaster prone state but it does face storm surge and rising tide threats along its coast. This July and last July some communities suffered flooding. Winter storms damage is not uncommon. Wildfires, tornadoes, hurricanes, earthquakes—those have been rare, thus far anyway.

“We’re really just trying to stay ahead of the curve,” offered Bettencourt, who believes that when people experience a major weather catastrophe, “their minds are going to be in a thousand different places.” He wants the department to be an obvious resource. So, for instance, if citizens have to go to a shelter to get information, he wants the department to be there to make sure insurance is part of the conversation.

“We obviously believe that an individual’s insurance coverages are going to be a big part of getting that individual’s life back on track,” he said.

He said the emphasis on communications and customer service is especially important to those who do not have an agent to call and for whom contacting their carrier is an unpleasant undertaking.

“The other thing is I think there are consumers who want to hear from an authoritative source in answer to a particular question or want to understand if the company’s handling their claim in the appropriate way,” he added.

For Bettencourt, the volume of calls in to NHID, along with the $6.5 million recovered for insureds every year, are measures of how well NHID is doing.

In fact, the more calls, the better.

“My goal is by the time I leave here to have that number at 10,000 or more calls a year, because that’s going to indicate to us that all of our outreach efforts are paying off,” the Granite State commissioner said.

Was this article valuable?

Here are more articles you may enjoy.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  ‘Structural Shift’ Occurring in California Surplus Lines

‘Structural Shift’ Occurring in California Surplus Lines