Bermuda-based Aspen Insurance Holdings Limited reported net income after tax of $120.4 million, or $1.66 diluted net income per share, for the quarter ended March 31, 2014.

Operating highlights for the quarter ended March 31, 2014 were listed as follows:

– Gross written premiums increased overall by 10.6 percent to $855.5 million in the first quarter of 2014 from the first quarter of 2013.

– Gross written premiums in Reinsurance and Insurance increased by 7.4 percent and 14.8 percent respectively from the first quarter of 2013

– Combined ratio of 87.6 percent (87.0 percent excluding non-recurring corporate expenses) for the first quarter of 2014 compared with 90.1 percent for the first quarter of 2013. There were $10.6 million, or 1.9 combined ratio points, of catastrophe losses pre-tax net of reinsurance recoveries and reinstatement premiums in the first quarter of 2014 compared with no catastrophe losses in the first quarter of 2013

– Net favorable development on prior year loss reserves of $28.2 million, or 5.0 combined ratio points, for the first quarter of 2014 compared with $26.2 million, or 5.1 combined ratio points, for the first quarter of 2013

– The loss ratio of 50.9 percent for the first quarter of 2014 compared with 52.6 percent for the first quarter of 2013. The accident year ex-catastrophe loss ratio of 54.0 percent compared with 57.7 percent for the first quarter of 2013

Financial highlights for the quarter ended March 31, 2014 were:

– Annualized net income return on average equity of 16.0 percent and annualized operating return on average equity of 14.8 percent for the first quarter of 2014 compared with 11.6 percent and 10.8 percent, respectively, for the first quarter of 2013(1)

– Diluted net income per share of $1.66 for the quarter ended March 31, 2014 an increase of 44 percent from diluted net income per share of $1.15 for the first quarter of 2013

– Diluted operating income per share of $1.55 for the quarter ended March 31, 2014 an increase of 46 percent from $1.06 for the first quarter of 2013

– On a pre-tax basis, net catastrophe losses were $10.6 million, or $0.16 per diluted share, for the first quarter of 2014 compared with no catastrophe losses in the first quarter of 2013

– Diluted book value per share of $42.72 at March 31, 2014, up 4.4 percent from December 31, 2013 and up 5.0 percent from March 31, 2013

Aspen also gave an upbeat assessment of its outlook for the rest of the year, indicating that the company “continues to expect to achieve an operating return on equity of 10 percent in 2014, assuming a pre-tax catastrophe load of $185 million, normal loss experience and the current interest rate curve and insurance pricing environment.”

CEO Chris O’Kane commented: “We are very pleased with our strong results this quarter, which reflect the successful execution and growing impact of our three strategic levers: capital management, enhanced investment returns and optimization of our business portfolio. Our annualized operating return on average equity was 14.8 percent, the highest quarterly ROE since we began significant investments in our U.S. insurance lines in 2010. The U.S. Insurance teams continued their trajectory of profitable growth and International Insurance achieved a solid quarter. Our Reinsurance business had yet another strong quarter and remains a preferred trading partner for our clients.

“We continue to execute on targeted growth opportunities building off of our prior investments and the strength of our teams. Historically, we invested in both Insurance and Reinsurance to position our businesses for profitable growth. Those investments are paying dividends and driving meaningful improvements in our results. We expect the benefits garnered from those investments to continue to increase in the coming years and to drive premium growth faster than both expenses and allocated risk capital, which will result in continued improvement in ROE.”

Source: Aspen Insurance Holdings

Topics Profit Loss Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

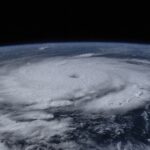

Hurricane Beryl: Insurers See Minimal Impact, Brace for Active Season

Hurricane Beryl: Insurers See Minimal Impact, Brace for Active Season  Damage From Hurricane Beryl May Cost Insurers $2.7B in US, $510M in Caribbean: KCC

Damage From Hurricane Beryl May Cost Insurers $2.7B in US, $510M in Caribbean: KCC  The Battle Over J&J’s Bankruptcy Plan to End Talc Lawsuits

The Battle Over J&J’s Bankruptcy Plan to End Talc Lawsuits  AT&T Says Data From Around 109M Customer Accounts Illegally Downloaded

AT&T Says Data From Around 109M Customer Accounts Illegally Downloaded