The disruption currently taking place in insurance and reinsurance markets is at its most acute since the culmination of the financial crisis. Industry reserves, deteriorating earlier catastrophe losses and eye-popping expense ratios are combining with macro headwinds, changes in investor appetite and less predictable global capital flows. All of this is driving an increased focus on risk selection and cost of capital. The most visible result is a hardening of pricing across multiple business lines.

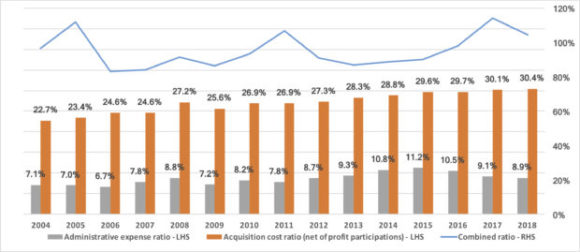

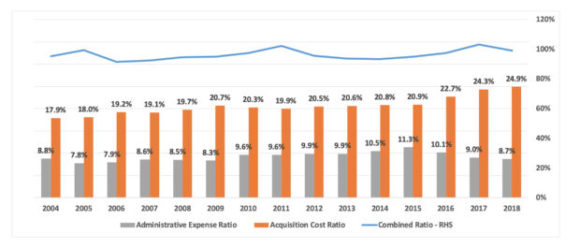

One of the factors increasing the cost of risk is rising broker commissions. The figures below show acquisition costs, net of reinsurance profit participations both at Lloyd’s and for the top 30 global carriers.

Lloyd’s

In the case of Lloyd’s, the acquisition cost ratio has risen from the low twenties in 2004 to the low thirties last year, an increase of nearly eight percentage points. By contrast, it is notable that the much-discussed Lloyd’s administrative expense ratio is now again below 10 percent, in line with both the broader market and the long-term trend. This follows the adoption of Lloyd’s London Market Target Operating Model (LM TOM), in particular,the introduction of the Platform Placing Ltd. (PPL) system. On the other hand, the increase in acquisition costs is despite 113 percent net earned premium growth at Lloyd’s since 2004.

Top 30

For the top 30 global carriers, the increase in acquisition costs was 7 percent, from 18 percent in 2004 to 25 percent in 2018.

The obvious questions for clients to ask are: “What are we paying for?” and “Why is it so much more expensive than it was in the recent past?” At least some of the increase is structural, that is, the sector’s distribution costs have risen noticeably pursuant to broker M&A and higher levels of concentration among the very largest intermediaries. Some of this is down to “soft dollars” paid for inward business in the form of analytical and advisory fees that are bundled into outward reinsurance brokerage.

While the high cost associated with these distribution channels made sense in the past, technology should lessen the need for carriers to pay an intermediary for bundled acquisition and relationship services. A reduction in these costs will enable insurers to gain a critical competitive advantage.

Technology and analytics play an important part in how to fix this issue, and Hyperion X, the technological and analytical branch of Hyperion, is among the companies seeking to create better alternatives. Our initiatives, for example, include the launch of a new digital marketplace through which carriers can find risks at lower acquisition costs using rating engines and machine learning, and an underwriting facility known as Rethink, where business is underwritten at a predetermined level using five years of proprietary loss data.

Emerging leaders in the insurance industry will need to optimize distribution for profit at the lowest possible cost in order to compete and win.

(Editor’s note: David Flandro is one of 15 executives who responded to five questions posed by Carrier Management about their technology-related businesses and why carriers should care about them. The Q&As for Flandro and each of the other leaders is available in CM’s online exclusive supplement, “InsurTechs to Watch: The Distribution Channel.”)

This article first was published in Insurance Journal’s sister publication, Carrier Management.

Topics Excess Surplus Tech Lloyd's

Was this article valuable?

Here are more articles you may enjoy.