Parametric catastrophe facility CCRIF paid the government of Guatemala approximately US$3.6 million under its excess rainfall (XSR) parametric insurance policy for nine days of rain that occurred during Tropical Storms Amanda and Cristobal.

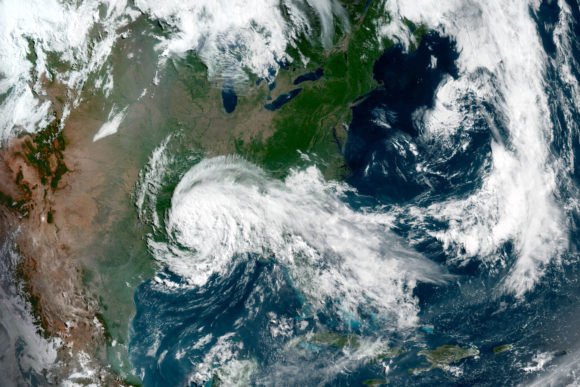

The policy was triggered by rains that started on May 31. Storm Amanda, which originated in the Pacific Ocean, initially made landfall on Guatemala’s Pacific coast on May 31, causing flooding and landslides. This tropical storm dissipated but the remnants reorganized on June 1 to become Tropical Storm Cristobal, the third storm in the Atlantic Basin – a rare cross-over tropical cyclone with origins in the Pacific Basin.

Amanda and Cristobal led to more than a week of devastating rainfall across parts of Central America, said CCRIF in a statement.

CCRIF’s payouts are made quickly – within 14 days of an event – which is possible because the insurance policies are parametric as opposed to indemnity or traditional insurance.

Parametric insurance products are insurance contracts that make payments based on the intensity of an event (for example, hurricane wind speed, earthquake intensity, or volume of rainfall) and the amount of loss is calculated in a pre-agreed catastrophe model, explained CCRIF.

Therefore, payouts can be made quickly after a hazard event, as parametric insurance does not require an on-the-ground assessment of individual losses after an event before a payment can be made – a process that can take months.

Guatemala became a member of CCRIF in 2019 and is receiving a payout within its first year of joining the facility. This payment is being made under Guatemala’s policy for 2019/20. The new policy year started on June 1, 2020, for which Guatemala has renewed its excess rainfall coverage.

CCRIF currently has 22 member governments three of which are from Central America – Nicaragua, Panama, and Guatemala. Since its inception in 2007, CCRIF has made a total of 43 payouts for 21 events (earthquakes, tropical cyclones, and excess rainfall events) to 14 member governments totaling US$155.8 million.

In the 2019/20 policy year, CCRIF made five payouts as follows:

- Two payouts to The Bahamas totalling US$12.8 million following Hurricane Dorian, which battered the Abaco Islands and Grand Bahama in September 2019;

- One payout to Trinidad and Tobago totaling US$362,982 for its excess rainfall policy, which was triggered due to rainfall associated with Tropical Cyclone Karen in October 2019;

- One payout to Belize totaling US$203,136, also due to rains from Amanda and Cristobal;

- The current payout to Guatemala.

About CCRIF SPC

CCRIF was formed in 2007 as the world’s first multi-country risk pool. Developed under the leadership of the World Bank with a grant from Japan, it was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by Canada, the European Union, the World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. In 2014, the facility was restructured into a segregated portfolio company (SPC) to facilitate new products and expansion into new geographic areas. It is now named CCRIF SPC and is based in the Cayman Islands.

Source: CCRIF SPC

Topics USA Catastrophe

Was this article valuable?

Here are more articles you may enjoy.

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed

Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed