Premium income for the London company market grew by 10% last year with £21.436 billion of large commercial and wholesale risks underwritten by firms in the City.

A new report from the International Underwriting Association also shows that another £6.197 billion was written in other offices outside of London but overseen and managed by London operations. Combining these two figures adds up to an overall premium of £27.633 billion for 2019 in the London company market.

Many companies are experiencing strong rates of premium growth across a wide range of business lines, according to the report. Also, firms are developing growth areas such as cyber and transfers of business from Lloyd’s of London into the company market.

Premiums written by the London company market increased by 8.1% to £28.437 billion in 2018, according to last year’s report published by the IUA.

Brexit continued to have an effect in 2019, with company restructurings necessitated by Brexit resulting in a large decline in the amount of ‘controlled’ premium written in European offices, but overseen and managed by London. A total of £4.508 billion previously written in this manner is now recorded by continental operations instead.

Without Brexit-related reorganisation, the premium income for the London company market in 2019 would likely be in excess of £32bn, rather than the actual figure of £27.633bn, according to the report.

Dave Matcham, chief executive of the IUA, said that his group’s members are continuing to serve their clients with new operational structures up and running. “Such restructuring has increased costs for IUA members, making them globally more inefficient and, ultimately, less able to offer a better deal for clients,” Matcham said.

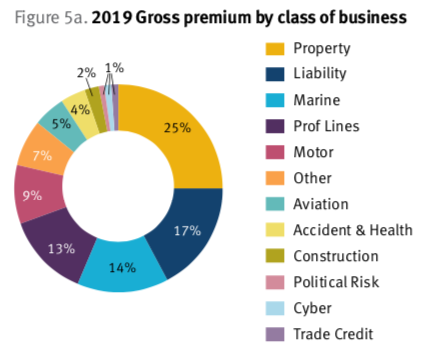

The report shows all classes of business appear to have benefited from improved market conditions to some extent but there has been particular growth in energy, aviation, property and professional lines. Marine, professional lines and aviation recorded growth rates over the past 12 months of 11.3%, 15.8% and 37.3% respectively.

In 2020, for the first time, the London Company Market Statistics Report identifies three new lines of business: political risk (£0.261bn), trade credit (£0.243bn) and standalone cyber (£0.253bn). Property remains the largest class of business (£5.365bn) followed by liability (£3.575bn).

More business is also being written through managing agents with the amount of delegated authority premium up by 28%.

The report is meant to supplement figures for the Lloyd’s marketplace, providing a central database for the dozens of companies operating independently in the London Market. The organization has been collecting statistics for a decade, over which time the market has grown from a total of £19.620bn in 2010 to £27.633bn for 2020.

Over the last decade, companies are increasingly operating in both the Lloyd’s and company markets. The contribution of Lloyd’s only entities has fallen from 41% to only 12% while those with a dual platform have almost doubled their presence from 35% to 67% of total premium, the report notes.

Other 2019 report findings:

- Premium underwritten in London is still mostly from direct/facultative placements (76%) with treaty business accounting for 24%. For business written elsewhere, but ‘controlled’ by London the picture is now different with direct/facultative at 55% and treaty up to 45%. Non-treaty income overall breaks down as 68% direct placements and 32% facultative.

- There has been a growth in premium written in London from all geographical regions, except for continental Europe. For controlled business, written outside London but overseen and managed by operations in the City, there has been a 60% drop in premium sourced from continental Europe.

Source: London Company Market Statistics Report

Topics Trends Europe Excess Surplus Lloyd's London

Was this article valuable?

Here are more articles you may enjoy.

Preparing for an AI Native Future

Preparing for an AI Native Future  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting