Global commercial insurance prices rose 11% in the first quarter of 2022, marking the fifth consecutive reduction in rate increases since pricing peaked at 22% in the fourth quarter of 2020, according to the Global Insurance Market Index published by insurance broker Marsh.

The first quarter of 2022 was the 18th consecutive quarter that global composite prices rose, which continued the longest run of increases since the inception of the Marsh Global Insurance Market Index in 2012. However, the rate of increase continues to moderate across most lines of business and in almost all geographies, said the Marsh report.

The major exception, said Marsh, was cyber insurance, driven largely by the continued increase in the frequency and severity of ransomware claims with many insurers seeking to tighten coverage terms and conditions, especially in relation to the conflict in Ukraine. “The war in Ukraine exacerbated concerns surrounding systemic exposures and accumulation risk,” added the report.

Rising cyber insurance rates were driven largely by the continued increase in the frequency and severity of ransomware claims with many insurers seeking to tighten coverage terms and conditions, especially in relation to the conflict in Ukraine. Prices increased 110% in the U.S. (down from 130% in Q4 2021), and 102% in the UK (up from 92%).

In the first quarter of 2022, slower rates of increase in financial and professional lines led to moderated rates in most geographies, but financial and professional lines continue to outpace property and casualty lines — driven primarily by cyber pricing — with rate increases averaging 26%, compared to 7% in property and 4% for casualty, the report said.

Global Insurance Composite Prices

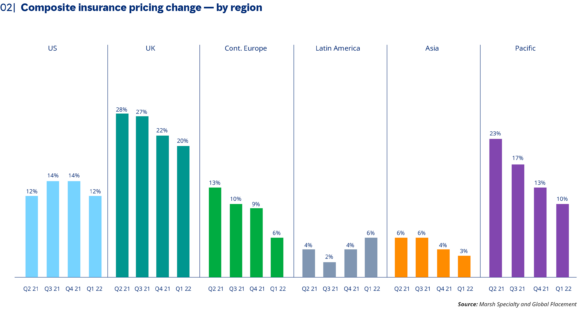

Global commercial insurance price increases across most regions moderated due to a slower rate of increase in financial and professional lines. The UK, with a composite pricing increase of 20% (down from 22% in Q4 of 2021), and the U.S., where prices increased 12% (down from 14%) continued to drive the global composite rate.

The rate of increase in Pacific was 10% (down from 13%), in Asia 3% (down from 4%) and 6% in Continental Europe (down from 9%).

For the second consecutive quarter, the one exception to the moderating trend for composite prices was Latin America and the Caribbean where rates increased by 6% (up from 4% in the fourth quarter of 2021).

In the United States, property insurance pricing increases mirrored those of the fourth quarter of 2021 at 7%, said Marsh, noting that clients with significant losses, as well as those that showed poor risk quality, or had significant exposure to secondary catastrophe (CAT) perils — including wildfire, convective storm, and pluvial flood — generally experienced rate increases that were well above average.

In two sections of the report — about U.S. and Continental European property pricing trends — Marsh indicated that insurers had shown an increased focus on the adequacy of valuations, due to the challenging environment caused by rapidly rising inflation. For example, in the U.S., according to Marsh: “Valuation has become a focal point at virtually every renewal for all insurers, particularly related to concerns about the current inflationary environment, supply chain challenges, and labor shortages. Loss experience where adjusted loss amounts were well above the reported values has further heightened insurers’ focus on this issue.”

Other findings from the survey include:

- Global property insurance pricing was up 7% on average in Q1 2022, down from an 8% increase in Q4 2021.

- Global casualty pricing was up 4% on average, down from 5% in the previous quarter.

- Pricing in financial and professional lines, largely driven by cyber, again had the highest rate of increase across the major insurance product categories, at 26%. However, this was down from 31% in the previous quarter, due to a slower rate of increase for directors and officers insurance.

- Increases in inflation are already impacting claims in several lines of business and have been flagged by insurers as a concern in affected geographies.

- U.S. property insurers appear to be managing their line sizes for secondary catastrophe perils, and tightening their pricing; as such, the capacity has significantly reduced, negatively impacting client portfolios that are predominantly exposed to wildfire.

- U.S. casualty insurance pricing increased 4%, in line with the fourth quarter of 2021 but excluding workers’ compensation, the increase was 6%. “The competitive workers’ compensation marketplace has helped to offset some of the increases in auto liability and general liability,” said the Marsh report, adding that insurers demonstrated willingness to negotiate on auto liability and general liability rates in order to secure more profitable workers’ compensation lines.

- UK property insurance pricing increased 9%, compared to 10% in the fourth quarter of 2021. Marsh noted that significant price increases were seen by clients “with major loss activity or a challenging occupancy or business process, such as food production, warehousing, or waste recycling.” “Insurers have moved from seeking to impose blanket price increases to targeting specific areas of the book they believe are underpriced or impacted by loss,” Marsh added.

- UK casualty insurance pricing increased 3%, compared to a 4% increase in the prior quarter (Q4 2021). The report said employers’ liability pricing was similar to that of the prior quarter. Electric vehicles (EV) affected claims in the auto insurance market significantly, with damage repair costs on electric vehicles running approximately 25% higher than cars with internal combustion engines, said Marsh, explaining that parts are hard to source and EV repair specialists are in short supply.

- Continental Europe’s property insurance pricing rose 6%, a decrease from 10% in the prior quarter. Catastrophe-exposed risks remained challenging and experienced the largest increases, though at a reduced level compared to prior quarters.

- Continental Europe’s casualty insurance pricing increased 6%, down from 7% during Q4 2021. Rates showed signs of stabilization, but with regional variations some territories saw double-digit rate hikes. Excess casualty and U.S.-exposed placements remained challenging, said Marsh, with some countries experiencing general liability pricing increases as high as 20%.

“The war in Ukraine, while most importantly a humanitarian tragedy, has added pressure to what is already a challenging insurance market for our clients. We are also beginning to see the impact of rising inflation on loss costs and exposure growth, which in turn could affect pricing,” commented Lucy Clarke, president, Marsh Specialty and Marsh Global Placement.

“However, market fundamentals remain strong and we expect rate increases to continue their moderating trend. We will continue to help clients find competitive pricing and coverage, as well as meaningful insights into how the quickly changing market dynamics may impact their risks.”

Was this article valuable?

Here are more articles you may enjoy.

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Preparing for an AI Native Future

Preparing for an AI Native Future  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’