Australia & New Zealand Banking Group Ltd. agreed to buy Suncorp Group Ltd.’s banking operations for A$4.9 billion ($3.3 billion) as it seeks to gain an edge over larger rivals by expanding in the country’s fastest growing region.

The lender plans to raise about A$3.5 billion of equity to help fund the takeover of the smaller Brisbane, Queensland-based business, which was agreed at a 12.7% discount to Friday’s closing share price. Suncorp Bank will continue to be led by Chief Executive Officer Clive van Horen who will report to ANZ head Shayne Elliott.

Australian banks are grappling with rapidly rising interest rates and falling house prices that’s spurred some investors to reevaluate lenders’ outlooks. The deal hands the lender control of one of the country’s largest retail banks that’s also based in the fastest-growing state by population, at a time when investor focus is shifting to expansion and away from cost-cutting.

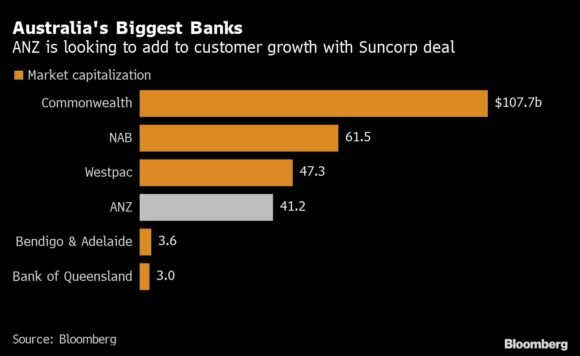

“ANZ are lagging as one of the smallest of the big four banks in Australia, so for them to expand their footprint to compete with Commonwealth Bank with something like a deal for Suncorp is really going to help them along in that respect,” said Jamie Hannah, deputy head of investments and capital markets at Van Eck Associates Corp., which holds about 2.5 million shares in ANZ.

“With this Suncorp deal they should overtake Westpac and whether or not they can catch up to National Australia Bank in the next year or so remains to be seen,” he said.

The deal marks a significant shift for Elliott, who in May told Bloomberg TV his bank was keeping cash on its balance sheet as it watches and waits for how customers react to rising interest rates. The transaction is expected to complete in the second half of 2023.

“With much of the work to simplify and strengthen the bank completed, and our digital transformation well-progressed, we are now in a position to invest in and reshape our Australian business,” Elliott said in the statement on Monday. “This will result in a stronger more balanced bank for customers and shareholders.”

As part of the transaction, ANZ will also acquire Suncorp Bank’s ATI capital notes at face value of about A$600 million as of June 2022, the statement said.

The deal is “equivalent of many years of organic system growth,” adding 1.2 million customers, a 20% increase, as well as a 17% step up in home loans and a 20% rise in small business clients, Elliott said in a conference call with investors following the announcement.

Suncorp said last month it was reviewing strategic alternatives for its banking operations. Banking and wealth accounted for 14% of full-year revenue in fiscal 2021, down on the previous 12 months, according to data compiled by Bloomberg.

What Bloomberg Intelligence Says…

Suncorp’s banking unit fits ANZ well given its higher exposure than most Australian peers to retail customers and to Queensland state, according to Bloomberg Intelligence analysts Matt Ingram and Jack Baxter.

“Synergies will be tricky to gain as Suncorp branches won’t close for three years, but ANZ says the deal is neutral to 2023 EPS,” Ingram and Baxter wrote in a report Monday.

Selling the banking unit to become a pure-play insurer would also boost Suncorp’s profitability, Ingram and Baxter wrote last month.

ANZ said in a separate statement Monday that it had also withdrawn from discussions with KKR & Co. about a potential acquisition of accounting software firm MYOB Group Ltd.

ANZ shares remain in a trading halt as the bank executes the capital raising. Suncorp’s stock rose as much as 7.2% in Sydney trading Monday and was 4.7% higher as of 2:02 p.m.

Photograph: A pedestrian is silhouetted as he walks past an illuminated logo at an Australia & New Zealand Banking Group Ltd. (ANZ) branch in Sydney, Australia, on Tuesday, Aug. 18, 2020. Photo credit: Brent Lewin/Bloomberg.

Was this article valuable?

Here are more articles you may enjoy.

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT