Munich Re said it will probably take a hit of about 1.6 billion euros ($1.6 billion) after hurricane Ian led to massive damages in Florida, and warned reaching its full-year profit goal has become “significantly more challenging.”

The estimate of losses from the storm is “subject to substantial uncertainty,” the company said in a statement Friday. Shares of the reinsurer rose after saying it expects to post a higher-than-expected profit of about 500 million euros [$489.3 million] for the third quarter, helped by a one-off effect at its Ergo life unit.

Ian hit Florida in September and was one of the strongest hurricanes to ever make landfall in the US. It carved a trail of ruin across southern Florida, downing bridges, inundating roads and shattering homes. Insured losses have been estimated at more than $60 billion.

Swiss Re AG warned earlier this week that it will post a third-quarter loss and may not reach a profitability goal for this year because of claims tied to the storm.

Munich Re said reaching its target for a profit of 3.3 billion euros this year now depends on the “realization of currently anticipated positive one-off effects, particularly regarding investments.”

Shares of the company rose 1.1% at 1:32 p.m. in Munich, paring declines this year to 3.2%.

“The scale of Hurricane Ian’s losses, particularly in Florida, will likely mean insured losses will drift higher as inflation and litigation add to the toll,’ Bloomberg Intelligence analysts wrote in a note. “Hurricane Ian could turn out to be a record-breaking storm.”

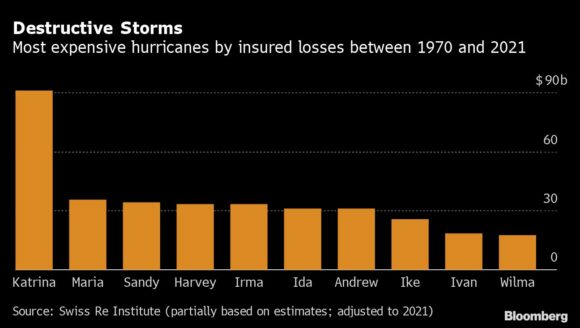

The most expensive hurricane for the industry so far since 1970 was Katrina with $91 billion in insured losses, followed by Maria and Sandy with about $35 billion each.

At Munich Re, the losses from Ian add to a number of other headwinds in the wake of financial markets volatility and the war in Ukraine. In the second quarter, the company took a hit of almost $1 billion to its investment portfolio. It also wrote down the value of Russian and Ukrainian bonds by almost 700 million euros in the first quarter and booked war-related reinsurance costs in the three-digit million euro range.

Photograph: A destroyed house following Hurricane Ian in Fort Myers Beach, Fla., on Tuesday, Oct. 4, 2022. Photo credit: Eva Marie Uzcategui/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud

Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud  Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals  Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance