Insurance companies in Switzerland are set to repay billions in mostly discounted old-style bonds over the next decade as changes to the country’s capital rules take effect next year.

There are nearly $20 billion of subordinated notes that Swiss insurers have been able to use as capital under a previous regime that will be grandfathered until the end of 2033, based on data compiled by Bloomberg. Swiss Re AG has kickstarted the process of dealing with them, buying back hundreds of millions of its bonds.

It’s the beginning of a long period of potential redemptions, buy backs and exchanges that could trigger price jumps in the affected bonds. There’s also a similar multibillion-dollar replacement of legacy bonds among insurers in the euro area after a change in the bloc’s rules.

“We expect the grandfathering feature to be one of the incentives for calling the bonds, notably those close to the end of the grandfathering period,” wrote Martina Seydoux and Larissa Knepper, senior analysts at CreditSights Inc., in a note to clients on Thursday.

The amended versions of Switzerland’s Insurance Supervision Act and the Insurance Supervision Ordinance will require new junior bonds to plug capital holes. The old-style hybrids will remain valid for 10 years, allowing time for insurance companies to deal with them.

The large-scale replacement could be a boon for holders as these notes are typically indicated at a discount on the secondary market. The average price of insurance hybrids stands at 91% of face value, based on data compiled by Bloomberg.

Some Swiss Re bonds rose in value after a buyback announcement last month as the company offered to pay a premium over prevailing market levels. It announced final results on part of the buyback on Wednesday. A spokesperson at the Zurich-based insurer declined to comment.

A similar round of replacements, replete with sudden price rises, has been happening in the euro area, where insurers have been acting ahead of the grandfathering deadline of the so-called Solvency II rules.

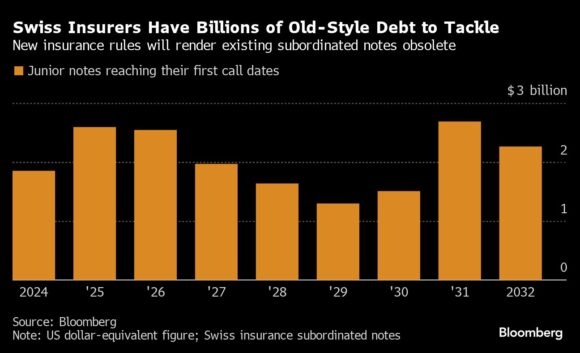

The Swiss replacements may still take years as more than half of the notes reach their first optional call date only in 2028 or later. Issuers may take note of low market prices and try to convince holders to hand over the bonds sooner.

“Tenders and exchanges should remain elevated also as the Swiss insurers look to take advantage of low cash prices,” the CreditSights analysts wrote.

Photograph: A cyclist rides his bicycle past Swiss Re AG’s headquarters in Zurich, Switzerland. Photo credit: Philipp Schmidli/Bloomberg

Topics Carriers Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Preparing for an AI Native Future

Preparing for an AI Native Future  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters