Insurance giant Allianz SE is looking to replace the biggest bond remaining under Europe’s old regulatory regime as it taps the market for new issues early on this year.

The Munich-based insurer priced a new €1 billion junior note on Wednesday while proposing to buy the entire €1.5 billion perpetual note that is set to lose regulatory value at the end of 2025.

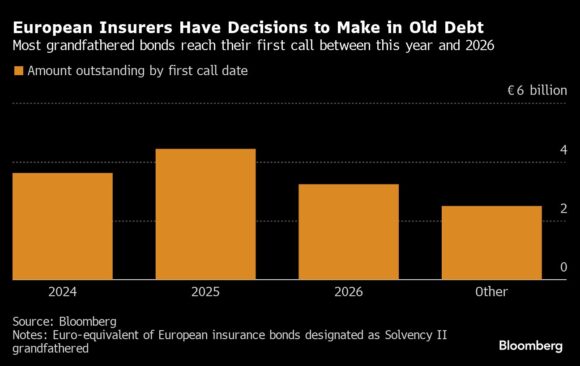

Allianz’s move to manage its debt is the latest in a series of operations by European insurers over the past year dealing with subordinated issues that regulators will cease to recognize as capital. There are still €13.8 billion of so-called Solvency II grandfathered notes by European insurers outstanding, with Allianz’s issue being by far the largest, based on data compiled by Bloomberg.

Market activity on Tuesday showed that investors have appetite for new issues, a spokesman for Allianz said by email. Buyers placed more than €30 billion of orders, or almost twice the amount sold, for the bonds launched on the first trading day of the year in Europe, based on data compiled by Bloomberg.

The timing of Allianz’s operation also reflects its conservative approach to managing refinancing risk, the spokesman said.

The rule-set known as Solvency II came into force in 2016 with the aim of making insurance companies more resilient. It dictates capital requirements for the insurers and granted them a 10-year grace period to deal with junior bonds that don’t satisfy the regulations.

Allianz’s perpetual note is rising only marginally on the secondary market after the announcement as it was already indicated near face value, based on data compiled by Bloomberg. The old note also includes an early redemption option in September.

The new tier 2 bond, which is callable after 10.5 years, was priced at a yield of 4.851%, according to a person familiar with the matter, who asked not to be identified because they’re not authorized to speak about it.

Topics Mergers & Acquisitions Europe K-12 Allianz

Was this article valuable?

Here are more articles you may enjoy.

Pet Insurance, Agents Gets a Shorter Leash Under Bill DeSantis Signed Into Law

Pet Insurance, Agents Gets a Shorter Leash Under Bill DeSantis Signed Into Law  NJ Wildfire Update: 50% Contained; High Spread Risk Today; Suspect in Custody

NJ Wildfire Update: 50% Contained; High Spread Risk Today; Suspect in Custody  USI Says Lockton, Former Team Leader Poached Workers, Harmed Client Relations

USI Says Lockton, Former Team Leader Poached Workers, Harmed Client Relations  State Farm Wins Dismissal of Class Action Over Xactimate Software

State Farm Wins Dismissal of Class Action Over Xactimate Software