The UK’s second biggest mortgage provider has stopped making loans on homes at risk of flooding, over fears they may become uninsurable — and therefore, unsellable — over the coming years.

Nationwide Building Society uses mapping technology to identify which individual homes are vulnerable to flooding, Nationwide Head of Property Risk Rob Stevens said in an interview. The company will decline to make a loan to purchase a property it deems to be at high risk.

“If we’re doing a 40-year mortgage term and there’s something there that I know could fundamentally change for the customer, I can’t not know that,” says Stevens. He says he has personally phoned buyers to warn them when their prospective homes are at risk of flooding.

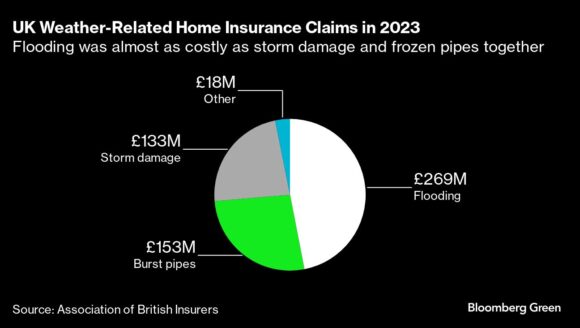

Almost 7,000 UK homes and businesses have been flooded in the past 18 months, which have been the wettest on record. Property insurers paid a record £2.55 billion ($3.2 billion) in home insurance claims in 2023, a 10% increase over 2022 driven by damage from storms Babet, Ciaran and Debi.

Most UK homes at high risk of flood damage can still get coverage thanks in part to a government-backed program called Flood Re, funded through a small premium on everyone’s home insurance.

But Flood Re’s mandate is set to expire in 15 years. The average UK mortgage term is more than 20 years, and twice that for first-time home buyer.

RBNZ Says Insurance May Become Unaffordable for High-Risk Homes

Created in 2016, Flood Re was designed to cushion the blow to private insurers while the government improved public flood defenses, reducing overall risk in the market. The Environment Agency, responsible for delivering the program, estimates that 40% fewer homes will be protected by 2027 than the 2020 target called for.

Nationwide’s Stevens says he remains optimistic that “flood risk management is likely to continue to evolve and improve,” which would mean Nationwide’s pool of properties eligible for mortgages wouldn’t shrink dramatically.

It’s “rare” that the company is unable to lend and that and can also be due to other issues such as “subsidence or the quality of construction,” Stevens said in a separate e-mail on Tuesday. “However, in the overwhelming majority of cases, we are able to lend on homes even where issues have been identified.”

A spokesperson for the Department for Environment, Food and Rural Affairs, said that more than 500,000 properties have benefited from better access to flood insurance since the program was launched.

The department will “continue to work closely with Flood Re and industry ahead of the scheme ending to ensure people can continue to access affordable insurance,” the spokesperson said.

Photograph: Floodwaters in Wraysbury, UK, in January 2024. Photo credit: Daniel Leal/AFP/Getty Images

Topics Flood

Was this article valuable?

Here are more articles you may enjoy.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions