There was a time when investing in catastrophe bonds was the preserve of hedge funds and other sophisticated alternative asset managers. But after underpinning the best hedge fund strategy of 2023, the bonds are finding a wider audience.

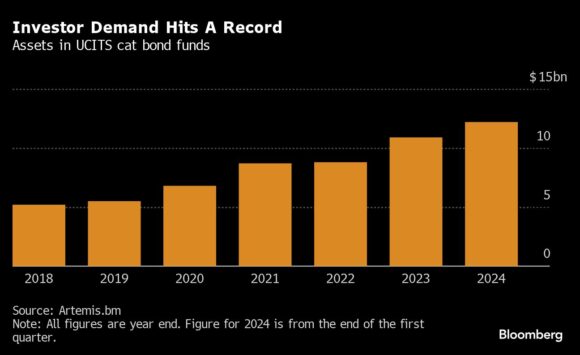

Catastrophe-bond funds marketed under Europe’s UCITS label, which is designed to protect retail investors, have seen their assets under management rise 12% this year to a record $12 billion, according to Kepler Partners, a research and advisory firm. The development means that cat bonds, as they’re often called, sold through UCITS now make up roughly a quarter of the entire market for such debt.

“We’ve seen a broadening of the UCITS market for cat bonds since the end of 2022,” said Matthew Barrett, partner at Kepler. “It’s a very rich period for the asset class.”

Catastrophe bonds are generally issued by insurers looking to pass a chunk of their risk over to capital markets. Issuance has picked up lately, with factors including climate change, population density and inflation adding to the potential losses that insurers face. Investors in the bonds stand to generate market-beating returns if a predefined catastrophe doesn’t occur, but can face substantial losses if it does.

Issuance of cat bonds is set to hit a record this year. At the same time, some specialist investors are reviewing their positions as they brace for what meteorologists are forecasting will likely be a particularly active hurricane season with the potential to unleash significant property damage.

Extreme weather fueled by global warming is a major reason insurers are keen to pass on loss risks to cat-bond investors. But where people are choosing to build is adding to the potential cost of a natural catastrophe.

Impax Asset Management recently noted that the human and financial costs of natural catastrophes “are amplified by demographic and economic trends,” with 29% of the increase in insured losses arising from severe US convective storms between 2008 and 2023 attributed to urbanization.

It’s against that backdrop that the market for cat-bond UCITS is taking off.

What Are UCITS:

UCITS, which stands for Undertakings for Collective Investment in Transferable Securities, are essentially mutual funds covered by European regulations intended to make them safe enough to market to retail investors. As such, UCITS represent the largest retail investment sector in the EU.

Schroders Plc says its UCITS cat-bond fund has grown by $390 million so far this year. Leadenhall Capital Partners also offers a UCITS cat-bond fund, which has tripled assets to almost $900 million in the last 18 months. Amundi SA’s US-focused cat-bond mutual fund, launched in February 2023, has accumulated about $328 million in assets, according to Bloomberg data.

“We believe the combination of continued elevated pricing, combined with the ongoing demand for reinsurance, may present an attractive investment opportunity throughout the remainder of 2024 and into 2025,” Amundi said in a May report on cat bonds.

Fermat Capital, the world’s largest cat-bond investor with about $10 billion of assets, started its own UCITS cat-bond fund in February and has already attracted $540 million of assets, according to data compiled by Bloomberg. A large portion of that was transferred from a separate UCITS fund that Fermat manages for another asset manager, according to Artemis, which tracks the cat bond market. Fermat declined to comment.

Hedge Fund Fermat Has Best Year Ever as Catastrophe Bonds Deliver Record Result

The asset managers say they aren’t selling cat-bond funds directly to retail investors, but the securities’ presence in UCITS enables more investors to participate in the asset class.

Dirk Schmelzer, senior fund manager for insurance-linked securities at Zurich-based Plenum Investments AG, says high returns “have created additional interest” among banks, family offices and pension funds.

“We’re not actively marketing to the retail space,” he said, but banks hold cat bond funds in their discretionary accounts, “so retail investors will ultimately end up being exposed.” Plenum manages two UCITS cat-bond funds.

It’s a development that regulators are monitoring. The European Securities and Markets Authority began a call for evidence last month, as it seeks information on the ramifications of having cat bonds and other risky securities available in UCITS.

Asset managers Bloomberg spoke with say they’ve recently been contacted by ESMA as the watchdog tries to get an overview of how widespread cat bonds are in UCITS.

“Cat bonds have grown to be a significant UCITS allocation,” said Barrett of Kepler. “ESMA is doing a sense check” to find out whether the rules are being used as intended.

Plenum says cat bonds have proved their resilience during times of market stress.

“We’ve never had a liquidity crisis,” said Schmelzer. Even during the financial crisis of 2008, any cat-bond investors who wanted to offload their holding were able to do so, he said.

Though a broader group of investors now holds cat bonds, insiders say it’s their impression that the market continues to be dominated by veterans with a deep understanding of how the securities work.

“It’s mainly been pension fund money over the last 10 to 15 years,” said Lorenzo Volpi, deputy chief executive at Leadenhall. “Now we’re seeing more multi-asset funds, family offices and even life insurers” keen to invest.

Daniel Ineichen, the co-head of insurance-linked securities at Schroders Capital, the private markets division of Schroders Group, says “it’s a market dominated by professional investors,” though many prefer regulated funds with the UCITS label.

“Last year we saw new investors coming to Schroders for ILS, predominantly family offices and some wealth management platforms,” he said. “There’s interest from Europe, Asia and Australia.”

Cat bonds currently offer “a spread of about 9% above the risk-free rate” of US Treasuries, Ineichen said. “It’s a significant yield gap” compared with regular corporate bonds, and it’s been “reinforced by record issuance.”

That said, this year’s hurricane season is putting pressure on asset managers to ensure they’re ready.

Schroders has “adjusted the portfolio slightly,” Ineichen said. “We’re running a slightly higher cash balance.”

Photograph: A flooded street running parallel with the River Neckar in Heidelberg, Germany, on Monday, June 3, 2024. Photo credit: Alex Kraus/Bloomberg

Related:

- Catastrophe Bond Sales Soar as Markets Brace for Unusually Active Hurricane Season

- Catastrophe Bonds Use Models Underestimating Climate Risks, Investors Say

- Worsening Weather Igniting $25 Billion Weather Derivatives Market

- Hedge Funds Rake in Huge Profits Betting on Catastrophe Risk

Topics Catastrophe

Was this article valuable?

Here are more articles you may enjoy.

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market