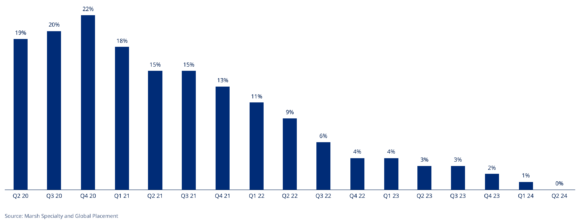

Global commercial insurance rates remained flat during the second quarter of 2024 (down from a 1% increase in Q1 2024), according to Marsh’s Global Insurance Market Index.

The findings mark the first time in nearly seven years – since the third quarter of 2017 – that the global composite rate has not increased, Marsh said, noting that the continued moderation of rates was largely driven by increasing competition among insurers in the global property market.

On average, Q2 rates decreased by 5% in Canada and the Pacific, and by 3% in the UK and in Asia regions. Rates increased in the US and Europe by 1%, and by 4% in the Latin America and the Caribbean and India, Middle East, and Africa (IMEA) regions.

Other findings in the report included:

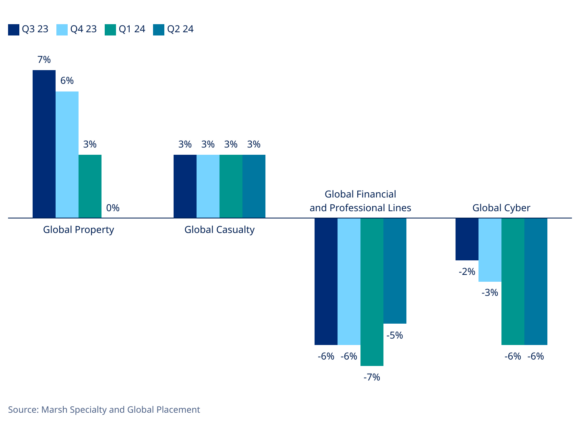

- Property insurance rates globally were flat compared to 3% and 6% average increases in Q1 2024 and Q4 2023, and either declined or moderated in every region except IMEA, said Marsh, noting that property insurers are closely watching the Atlantic hurricane season to see if any substantial storm activity might significantly affect their business.

- In the US, property insurance rates rose 2%, compared to an average increase of 8% in Q1 2024.

- Casualty lines rates increased 3% globally, the same level as the previous six quarters. Canada and Asia showed decreases while the UK and IMEA were flat. Marsh said that insurers remain concerned about large jury awards in US courts.

- In the US, casualty rates increased 4% during Q2; excluding workers’ compensation, the increase was 7%.

- Global financial and professional lines (FinPro) rates decreased for the eighth consecutive quarter – by 5% globally, compared with a drop of 8% in Q1 2022. While rate decreases were recorded in every region, in the US, UK, Canada, and Europe, the rates decelerated as compared to Q1 2024 and accelerated in other regions.

- In the US, Q2 FinPro rates dropped by 3%, compared to a drop of 5% in Q1 2024 and 6% in Q4 2023. Directors and officers liability rates continued to decline, though the pace of Q2 decreases moderated to 5% compared to 8% in Q1 2024.

- Cyber insurance rates decreased 6% globally – repeating the 6% decrease recorded in the prior quarter – with decreases in every region. Insurers continued to focus on cybersecurity controls, typically looking for year-over-year improvements in cyber resilience.

- In the US, cyber rates decreased by 5% — marking the fifth consecutive quarter when prices declined.

“We have seen the continued moderation of the global composite rate over the past few years, with a stable composite in Q2 2024, which is a positive movement for our clients,” commented Pat Donnelly, president, Marsh Specialty and Global Placement, in a statement.

All references to rate and rate movements in this report are averages, unless otherwise noted. For ease of reporting, Marsh has rounded all percentages regarding rate movements to the nearest whole number. Insurance broker Marsh is a subsidiary of Marsh McLennan.

Source: Marsh

Was this article valuable?

Here are more articles you may enjoy.

New York’s Mid-Hudson Insurance to Acquire Hanover Fire of Pennsylvania

New York’s Mid-Hudson Insurance to Acquire Hanover Fire of Pennsylvania  The $10 Trillion Fight: Modeling a US-China War Over Taiwan

The $10 Trillion Fight: Modeling a US-China War Over Taiwan  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  Kansas Man Sentenced for Insurance Fraud, Forgery

Kansas Man Sentenced for Insurance Fraud, Forgery