China Evergrande Group’s liquidators have launched court proceedings against PricewaterhouseCoopers LLP, another legal step to recover at least a fraction of creditors’ investments from the property giant.

Lawyers of liquidators have started legal actions against PwC and PricewaterhouseCoopers Zhong Tian LLP, the global auditor’s mainland China arm, according to Hong Kong court documents seen by Bloomberg. The lawsuit was filed in March and recently made public.

The legal move comes along with liquidators’ attempt to recover $6 billion in dividends and remuneration from seven defendants including Evergrande’s founder Hui Ka Yan, former chief executive officer Xia Haijun, former chief financial officer Pan Darong and Hui’s ex-wife Ding Yumei, according to a filing earlier this week.

China Weighs Record Fine for PwC Over Evergrande Audit Work

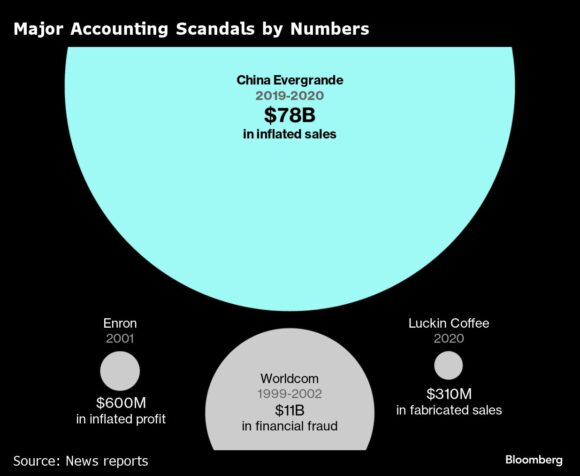

PwC has been in the spotlight for its role in Evergrande’s accounting, after Chinese authorities launched an investigation into one of the biggest financial frauds in history. Authorities earlier this year said it would impose a 4.18 billion yuan ($584 million) fine against Evergrande’s main unit, Hengda. Regulators said the firm overstated its revenue by 564 billion yuan in the two years through 2020.

“A collapse as large as China Evergrande severely undermines investors’ confidence in the system, and the only way to restore it is to have a transparent autopsy,” said Pingyang Gao, an accounting and law professor at the business school of the University of Hong Kong. He added that the liquidators’ legal actions and court proceedings will help with that process.

PwC Zhong Tian, a Shanghai-registered firm that is part of PwC’s global network, was Hengda’s auditor during the period in question. The firm served as Evergrande’s auditor for more than a decade until it resigned in January 2023 due to what the developer said were audit-related disagreements.

Evergrande paid 389 million yuan in auditing and other fees to PwC from 2009 to 2022, according to calculations based on the developer’s annual reports.

Liquidators launched court proceedings against PwC’s “negligence” and “misrepresentation” in auditing work. The claim relates to PwC’s reports on Evergrande’s financial statement for 2017 and the first six months of 2018, according to the filing. That’s ahead of the 2019 and 2020 period, during which Chinese securities regulators said the developer overstated its revenue.

Another court document filed in June showed that assets linked to Hui include two yachts, two Rolls-Royce Phantom cars, three planes, four luxury homes in Hong Kong and properties in London and Los Angeles.

The liquidators also started court proceedings against global commercial real estate services company CBRE Group Inc. and advisory group Avista Valuation Advisory over valuation reports they produced for Evergrande and its subsidiaries in 2018, according to a separate court document seen by Bloomberg.

China has been weighing a record fine on PwC, which is likely at least 1 billion yuan, people familiar said in May.

Photo credit: Bloomberg

Related:

- China Asks Large State Financial Institutions to Drop Auditor PwC, Sources Say

- PwC Weighs Halving of China Financial Services Audit Staff, Sources Say

- PwC Starts Mass China Layoffs After Losing Dozens of Clients

- Evergrande Liquidation Lawyers Probe PwC, Others to Recoup Creditor Losses: Sources

- China Scrutinizes PwC Role in $78 Billion Evergrande Fraud Case

- China Evergrande’s Alleged $78 Billion Fraud Is Among World’s Worst

Topics China

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation