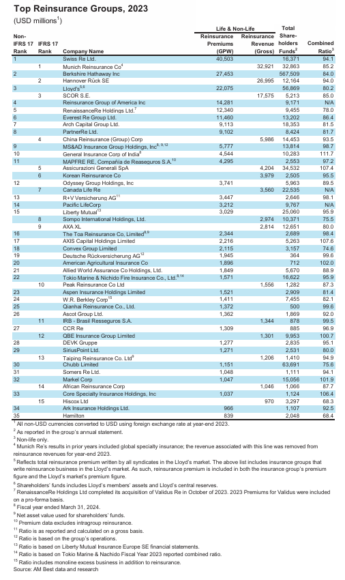

Munich Re tops the list of the world’s 50 largest reinsurers that use IFRS 17 reporting standards, while Swiss Re is the largest non-IFRS 17 reinsurer, according to AM Best.

Among the largest IFRS 17 reporting reinsurers, Munich Re is followed by Hannover Re and SCOR at numbers two and three. Topping the list of non-IFRS-17-reporting reinsurers are Swiss Re, Berkshire Hathaway and Lloyd’s. (See chart below).

In last year’s top 50 — pre-IFRS accounting rules — Munich Re ranked as the largest reinsurer while Swiss Re followed at number two. (For additional analysis of this year’s AM Best rankings, see related article in Carrier Management.)

The change from IFRS 4 to IFRS 17 diminished the comparability among reinsurers and shifted the traditional focus of re/insurers’ financial statements from premiums written and earned to one based on insurance revenue, explained AM Best in its report titled “World’s 50 Largest Reinsurers.” (The International Financial Reporting Standard 17 – IFRS 17 – became effective on Jan. 1, 2023).

AM Best noted that the global reinsurance industry is in the midst of “a generational hard market,” which has driven significant growth for many reinsurers. As a result of this turn of fortune, AM Best in June revised its outlook for the reinsurance sector to positive from stable, which is the first time the ratings agency has had a positive outlook on the segment.

“The hard market conditions reignited by Hurricane Ian and substantial secondary perils events in 2022 resulted in a continuation of significant rate increases as well as a tightening of terms and conditions that continued through the 2023 renewals,” the report said.

“Additional factors in 2022 – such as mark-to-market unrealized fixed-income investment losses, loss cost and social inflation, and global macroeconomic uncertainty – caused a substantial imbalance in reinsurance supply and demand dynamics,” AM Best continued. “In aggregate, these factors resulted in significant growth in premium volume, underwriting income, and net income.”

As a result of these hard-market dynamics, the reinsurance segment’s top-line growth was strong throughout 2023, AM Best said, noting that for the top 35 non-IFRS 17 companies, total reinsurance gross premiums written rose by more than 6% last year, “driven primarily by strong rate increases rather than exposure growth.”

“Despite global investment market turmoil and severe global catastrophic losses, many reinsurers reported strong underwriting results, which was supplemented by significant growth in fixed-income investment yields, driven by increases in reinvestment rates,” the report said.

Reinsurers’ performance continues to be bolstered by strong rates, tight terms and conditions, and high attachment points, AM Best continued. At the same time, there is little indication that “underwriting discipline in the market is waning.”

Diving into the results for some of the top companies, AM Best said, Munich Re and Swiss Re remain the largest global reinsurers under the different accounting standards. (Comparisons will be easier when Swiss Re moves to IFRS for the 2024 financial year).

To rank the reinsurers into one list, AM Best noted there was signficant negative movement for IFRS 17 reporters. As a result, users of the list of reinsurers should refer separately to the rankings in the non-IFRS 17 and IFRS 17 columns of the chart, AM Best explained.

- Munich Re reported GPW of US$51.3 billion in 2022. (This included global specialty insurance, which was removed from gross revenue for 2023). Excluding the global specialty insurance business, Munich Re’s third-party reinsurance revenue came to US$32.9 billion in 2023.

- Swiss Re, which is the largest of the non-IFRS 17 reporting companies, had gross life and non-life premium growth of 1.9% in 2023, driven by life premium growth of 5.8%, as non-life premium declined slightly by 0.7%. Swiss Re’s non-life gross premium rose 2.7%.

- Berkshire Hathaway reported 24% growth in third-party reinsurance premium to US$27.5 billion in 2023, up from US$22.1 billion in 2022. AM Best noted that the group acquired Alleghany in late 2022 for US$11.6 billion, in a deal that included TransRe, which wrote US$5.9 billion of gross premium in 2023, an increase of 2.5%, compared to $5.8 billion in 2022.

- Hannover Re reported a 4.9% increase in gross reinsurance revenue over 2022, adjusted for exchange rates. Gross reinsurance revenue for non-life reinsurance grew 6.5% over 2022.

- Lloyd’s saw premium growth of 19.1% from $18.5 billion to $22.1 billion. Growth benefited from the depreciation of the pound against the dollar, said AM Best. “When using consistent exchange rates, growth came to 7.2%.”

- Everest Re saw significant growth with gross premiums rising 23% to $11.5 billion from $9.3 billion.

- RenaissanceRe displaced Everest in the overall ranking with its 33.9% growth, which includes the impact of its acquisition of Validus Re.

- Convex reported gross premiums of 48.6% from $1.4 billion in 2022 to $2.1 billion in 2023. “Founded in 2019, the group is still relatively new but has been growing quickly, with surplus nearly doubling from its initial start-up capital in 2023. The company reached underwriting profitability three years after inception,” said AM Best, adding that Convex was first included in its top global reinsurers’ report in 2023.

On the other hand, not all reinsurers reported growth during the hard market, AM Best confirmed. For example, SiriusPoint saw a decline of 16.5% in premium, reporting $1.3 billion in 2023, from $1.5 billion in 2022. Markel also reported a 15% decrease in gross premiums to $1.0 billion from $1.2 billion in 2022.

New Entrants to the List

New entrants to the list of the largest reinsurers were Ascot Group and Ark Insurance Holdings. Founded in 2001, Bermuda-based Ascot now ranks 26th among non-IFRS 17 companies. It is a global specialty re/insurer that focuses on catastrophe-related risks in the United States.

Another addition to the list is Ark Insurance, now ranked 34th among non-IFRS 17 companies. Founded in 2007, Ark is a property, casualty and specialty re/insurer that operates through a Lloyd’s platform.

Topics Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen

Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen  A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch