The share of UK financial services firms worried about geopolitical risks is at its highest level since the 2008 crash, the Bank of England said.

The BOE’s biannual systemic risk survey, which began during the financial crisis, said on Wednesday that 93% of firms now see geopolitics as a key threat to the UK financial sector, up 8 percentage points. Fears about cyber-attacks also rose, while the percentage of firms citing the threat from an overseas or global economic downturn more than doubled to 33%.

The survey of 55 firms was carried out between July 23 and Aug. 12, before the most recent escalation of tensions in the Middle East.

The Financial Policy Committee, which includes BOE officials and external experts, nonetheless said that risks to UK financial stability were “broadly unchanged” from June 2024, according to minutes of its meeting held on Sept. 19.

The central bank continued to call out global risks, including hedge funds net short position in US Treasuries, which the BOE said had continued to rise. Their current level of $1 trillion exceeds the previous peak of $875 billion in 2019, the BOE said.

Still, officials noted that August’s volatility failed to trigger a significant unwind in hedge funds’ positioning, in contrast to the deleveraging that rocked global finance in March 2020.

Hedge funds’ use of borrowing to fund bond market bets, such as the so-called basis trade in US Treasuries, has been a longstanding concern for global authorities. In April, the International Monetary Fund warned a small group of funds’ wagers in the Treasury market were so big they could destabilize the broader financial system in times of stress.

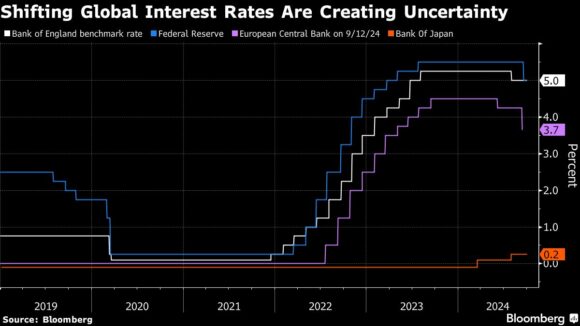

Meanwhile, central banks’ divergent policies on interest rates increase uncertainty for government bond prices. Even as the European Central Bank and the Federal Reserve cut their respective policy rates, the BOE held steady at its most recent meeting.

The FPC said that the market reaction to the Bank of Japan’s interest-rate increase in July “underscored the potential risk associated with this monetary policy normalization, which were important for financial institutions to be prepared for.”

Officials cited broader risks in the area of market-based finance, which includes everything from hedge funds to private equity, private credit and insurers. They warned that markets remained “susceptible to a sharp correction” after valuations, particularly in equities, returned to “stretched” levels following a spike in volatility in August.

UK banks, households and businesses continue to be broadly resilient, the BOE said, while warning that the full impact of the adjustment to higher rates has not yet been faced since some borrowers haven’t had to refinance their loans since rates started rising. A “significant portion” of UK corporate bonds are due to mature in the coming years, the report said.

In the mortgages market, the BOE said that a third of homeowners have not yet refinanced their loans at higher rates. While household mortgage costs relative to income are expected to increase, they will remain below historic peaks from the 1990s and global financial crisis, it said.

The BOE repeated warnings that artificial intelligence could pose a risk to financial stability, but said the technology’s impact was “highly uncertain” and that relatively little work had been done on its potential to pose risks for the financial system, as opposed to risks for individual firms.

Photograph: Commuters pass the Bank of England in the City of London. Photo credit: Jason Alden/Bloomberg

Related:

- Global Election Super-Cycle Raises Risk of Political Violence, Large Insurance Losses

- Geopolitical Risks: Why Underwriters Are Watching Aggregations

Was this article valuable?

Here are more articles you may enjoy.

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT