Zurich Insurance Group AG has amassed a substantial stake in Banco Sabadell SA, potentially giving it more influence over an important source of sales that’s facing a hostile takeover bid.

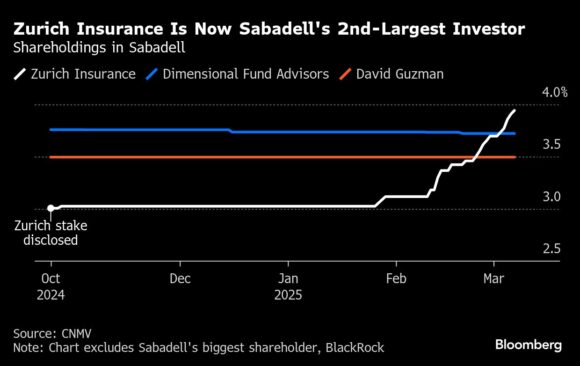

The Swiss firm has increased its holding in Sabadell to almost 4% since first crossing the notification threshold of 3% in October, according to data published by the Spanish regulator CNMV. The insurer started accelerating the purchases late last month and has recently become the bank’s second-largest investor, according to the CNMV website.

The growing investment comes while Sabadell is seeking to defend itself against a takeover by a larger domestic rival, BBVA SA. That bank, whose formal name is Banco Bilbao Vizcaya Argentaria SA, runs a joint venture with a Zurich competitor, Germany’s Allianz SE.

Zurich’s JV with Sabadell, through which the Spanish lender sells the Swiss firm’s insurance products, has long been a significant source of sales for Zurich. The “Bansabadell” entities generated $643 million in insurance revenue last year, according to the insurer’s latest annual report.

Representatives for Zurich and Sabadell declined to comment.

BBVA’s offer for Sabadell needs approval from various regulators before it can be presented to the target’s shareholders. Sabadell’s management has rejected the offer as too low and the bid has also faced pushback from the Spanish government, which has raised concerns about market concentration.

Zurich’s current holding in Sabadell has a market value of about €570 million ($618.3 million). The Spanish lender’s stock has risen about 45% this year to date, making it one of the best performers across major European banks.

Photograph: Customers use automated teller machines (ATM) at a Banco Sabadell SA bank branch in Barcelona, Spain, on Saturday, Oct 26, 2024. Photo credit: Angel Garcia/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’