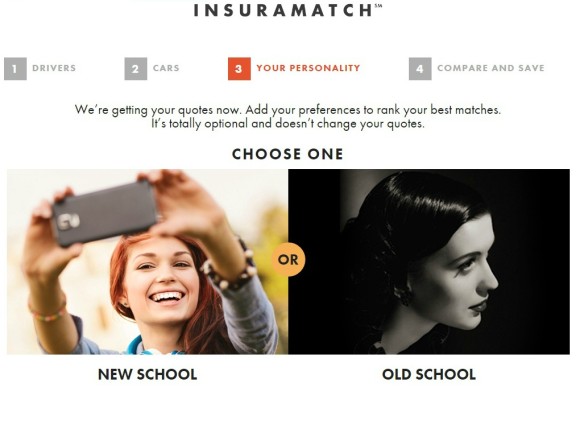

Do you prefer a fixed price or a la carte? How about paperless or paper? Are you a cat person or a dog person? Do you prefer “old school” or “new school”?

These are some of the optional questions for consumers from the personality/preference quiz portion of the auto insurance quoting system from InsuraMatch.com, the latest iteration of online insurance distribution.

InsuraMatch is a new venture from The Plymouth Rock Group of Companies that wants to match online shoppers with insurers. Its launch comes at the same time that giant search engine Google launched its comparative rating service in California.

Boston-based InsuraMatch says its online quoting system “digitally replicates the advice of a local agent” by including customers’ personality and preferences and the compatibility level with carriers when recommending carriers that also match each individual’s personal needs.

InsuraMatch is currently selling auto insurance in Pennsylvania and New York and will soon be in Connecticut. It also offers flood insurance to New Jersey residents.

It’s currently working with more than a dozen carriers including MetLife Auto and Home, 21st Century, Mercury, ASI, Foremost, Titan, American Modern, Esurance and Progressive.

InsuraMatch says Plymouth Rock is not among the carriers on InsuraMatch because it is not in New York or Pennsylvania at this point. When InsuraMatch writes flood, it can do so through Pilgrim, which is owned by Plymouth Rock and authorized to write flood under the federal flood program. InsuraMatch can also write flood through other partner carriers.

Quoting for homeowners and renters insurance will be introduced soon, the company says.

In addition to using the online interface, customers can contact InsuraMatch insurance producers by phone for a full product line of property/casualty insurance.

“We are part of a new class of super-agencies that are emerging in the marketplace,” said Marc V. Buro, CEO of InsuraMatch. “Plymouth Rock has always been a very entrepreneurial company. We saw an opportunity to enter this so-called super-agency space, but to do so in a differentiated way, to give consumers a different experience than what they are getting elsewhere, and that was exciting to us.

“While our online quote experience digitizes some of the kitchen table-conversation learning that a local agent would be able to have, it also offers our consumers with all of their options,” he said. “As a proponent of an agency model, we are very big on offering consumers the full gamut of options, price points, carriers and benefit features.”

How It Works

He said InsuraMatch uses a proprietary algorithm supported by a consumer research survey that the company fielded last summer and last fall. There are two phases in the algorithm that ultimately form the basis of the system’s match recommendation, according to Buro.

The first phase is the persona cluster analysis involving questions to derive a persona, questions that are asked in the normal course of generating insurance quotes.

In the second phase, InsuraMatch gives consumers the option to take a personality/preference quiz to gain a sense of their price sensitivity, service preference, carrier type, payment preference, and awareness of or interest in usage-based insurance. The answers to the quiz, and whether the shopper decides to take the quiz or not, have no bearing on rate, the company notes.

For example, when users choose answers that suggest they value companies that offer “green” initiatives, InsuraMatch factors this preference into its quote formula and provides a higher match score for carriers that are more aligned with the way these users want to do business, including providing discounts to environmentally-conscious customers.

In another example, consumers are presented with at least two occasions during the quiz on their price sensitivity. And for a highly price sensitive consumer, a carrier with the lowest rate would get an increased weighting in the match algorithm. And for someone who is not as price sensitive but who cares more about other service attributes, those types of attributes would weigh a little more heavily in the algorithm in presenting carriers.

The company says the matching formula is based on proprietary customer research and insurance carrier assessments. InsuraMatch hired global market research firm, LightSpeed GMI in Boston, to survey more than 3,000 insurance customers across the country to measure customer opinions and satisfaction levels on both regional and national insurance companies.

In addition, the InsuraMatch says its site will soon offer consumers hundreds of ratings and reviews from customers with first-hand experience with any carrier they’re considering.

Expansion Planned

Buro says his company is approaching its national expansion methodically and gradually. It will look to add the next wave of states in the latter part of third quarter and another group of states in the early part of 2016 — with each phase adding additional three to six states.

Buro says InsuraMatch is an online agency with respect to consumer marketing, supported by a corporate-run sales operation with 60-plus licensed producers on the sales floor.

The Plymouth Rock Group of Companies include Plymouth Rock Assurance Corp. and Bunker Hill Insurance Co. in Massachusetts and Connecticut, Pilgrim Insurance Co. in Massachusetts, Mt. Washington Assurance Corp. in New Hampshire and Plymouth Rock Management Co. of New Jersey. Together the firms write or manage more than $1 billion in personal and commercial auto and homeowners’ insurance in Massachusetts, New Hampshire, Connecticut and New Jersey. It sells through independent agents.

The new online agency doesn’t operate in states where Plymouth Rock operates as an underwriter currently, according to Buro.

InsuraMatch is not operating in Massachusetts and New Jersey, the two primary states where Plymouth Rock has substantial market share. InsuraMatch will begin operating in Connecticut soon, but Plymouth Rock does not have substantial market share in Connecticut, according to InsuraMatch.

Buro says Plymouth Rock has a history of providing insights and business best practices to its local agents based upon what it is doing in online marketing and sales and this will continue with lessons from InsurMatch.

“So to the extent that InsuraMatch is part of the Plymouth Rock family, InsuraMatch will also be part of the net exporter of insights, information and best practices that Plymouth Rock will be able to share with its agents in the states in which it writes as an underwriting carrier,” he said.

Related:

- Google Compare for Car Insurance Has Arrived

- Compare.com Confirms Partnership with Google Insurance Comparison Site

- Buying Insurance Is Like Online Dating? Or Loving a Local Agent?

- Google to Face Same Obstacles Selling Insurance Online, Says Overstock’s Byrne

- Walmart Begins Selling Auto Insurance Online

Topics Carriers Agencies Flood New Jersey Massachusetts Connecticut

Was this article valuable?

Here are more articles you may enjoy.

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation  US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI

US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI  A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions