The composite rate for commercial insurance placed in the United States moderated in June to minus 1 percent from minus 2 percent in May 2016.

“Insurers are getting tired of cutting rates,” said Richard Kerr, CEO of MarketScout. “There are still pockets of very competitive business; however, it is beginning to look like insurers are willing to maintain the rate reductions of the past few years and not cut rates even further.”

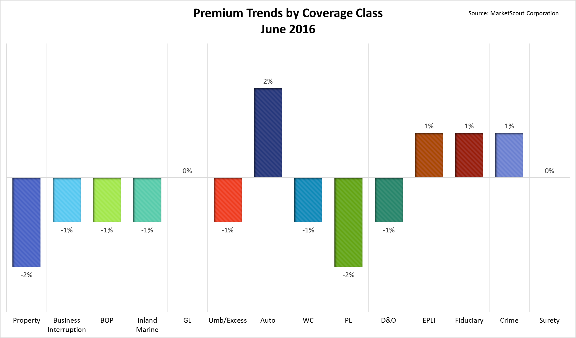

Coverage classifications business owners policies (BOP), umbrella and professional liability all moderated by 1 percent in June 2016 as compared to the prior month. Employment practices liability insurance (EPLI) rates were up 1 percent. Commercial auto rates moved from flat to plus 2 percent.

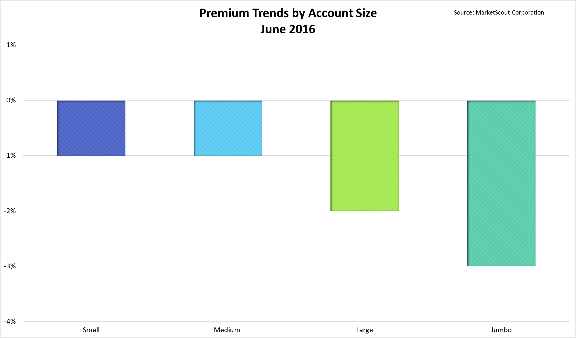

By account size, medium ($25,001 to $250,000) and large ($250,001 to $1,000,000) accounts moderated to minus 1 percent and 2 percent respectively. For all other account sizes, rates did not change.

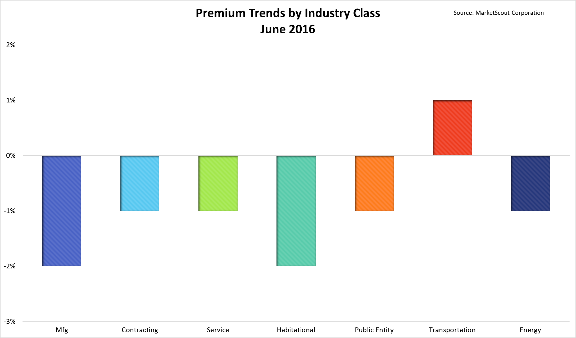

Rates for every industry class, except habitational and transportation, moderated by 1 percent. Habitational rates were unchanged at minus 2 percent while rates for transportation accounts moved significantly from minus 2 percent to plus 1 percent.

MarketScout is a Dallas-based national managing general agent and wholesale broker. The firm owns the MarketScout Exchange which helps retail agents find specialty markets.

For its market barometers, MarketScout uses information from its own Exchange database of actual renewal rates quoted on risks from across the country along with in-person surveys conducted by the National Alliance for Insurance Education and Research with as many as 2,000 agents and brokers a month.

A summary of the June 2016 rates by coverage, industry class and account size is below in charts provided by MarketScout.

Was this article valuable?

Here are more articles you may enjoy.

‘Structural Shift’ Occurring in California Surplus Lines

‘Structural Shift’ Occurring in California Surplus Lines  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market