Aite Group study finds that on average consumers will pay their auto insurance eight times per year and their property insurance five times a year.

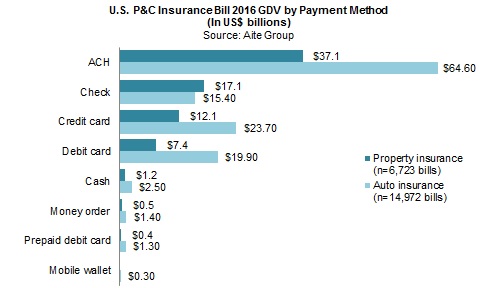

The Aite Group report, P&C Insurance: How Consumers Pay Their Bills, examines consumer preferences in the United States when it comes to paying property/casualty insurance bills.

Aite Group analysts suggest that insurance carriers that pay attention to the actual payment transaction can create value for their policyholders. Even though a “set it and forget it” approach is increasingly gaining favor, carriers should remember that a significant portion of clients prefer a more analog experience. The challenge for carriers is to strike a balance between analog methods and channels while promoting newer ones, according to the report.

“Not all people, not even all millennials, want a completely digital payment experience,” says Aite Group senior analyst Jay Sarzen. “P&C carriers should embrace this and recognize that there could always be some people, old or young, who will want a traditional manner of paying their bills.”

The report is based on a Q3 2016 Aite Group survey of 2,429 U.S. consumers and focuses on how different generations pay their P/C insurance bills.

Topics Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Portugal Deadly Floods Force Evacuations, Collapse Main Highway

Portugal Deadly Floods Force Evacuations, Collapse Main Highway  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call  Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh

Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk