As the U.S. market for telemedicine continues to expand, so does demand for insurance coverage for these providers, according to Beazley, which launched its product last summer.

The U.S. is the largest and most mature telemedicine market, with revenues projected by Orbis Research to exceed $7 billion by 2020. An Accenture 2018 consumer survey on digital health recorded that a quarter of consumers surveyed had received virtual healthcare services over the previous year, up from 21 percent a year earlier.

Telemedicine is also increasingly being used by workers’ compensation insurers. More specifically, there has been a recent uptick in interest by workers’ compensation carriers for virtual physical therapy, also known as telerehab, which provides virtual access to physical therapy and is intended to be a replacement for an in-person visit to an outpatient facility.

While it has its benefits, telemedicine can intensify certain risks for medical practitioners.

“It is clearly more difficult for a remote physician or other healthcare professional to intervene in a rapidly deteriorating or acute situation. And privacy risks are a constant concern,” the carrier reported.

As a result, companies are turning to the insurance market to help address these exposures.

“Telemedicine offers easier and often cheaper access to medical services for millions of Americans,” said Beazley underwriter Jennifer Schoenthal. “But at the interface between medicine and technology there are a variety of risks that are not fully addressed by traditional insurance policies.”

Beazley said its Virtual Care coverage has been purchased by more than 90 companies serving in aggregate tens of millions of patients in the U.S. since it was introduced by Beazley in July 2017. The policy combines coverage for medical malpractice, technology errors & omissions and privacy breaches, as well as general liability, products liability and coverage for completed operations. It also covers risks that are unique to telemedicine, such as the legal challenges that can arise when a doctor is in one state or country and his or her patients are in another.

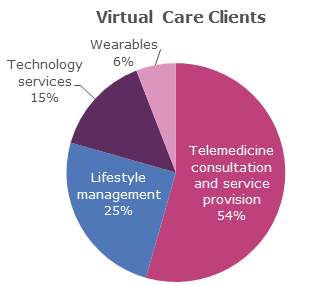

Beazley said most of its clients (see chart) are mid-sized and small healthcare service providers. These include remote providers of physician or psychiatric consultations through an app or online portal. But providers of lifestyle management services, such as weight loss coaching and treatments for male baldness, have also purchased coverage.

A third market segment comprises the technology companies that make telemedicine possible, including software/hardware manufacturers or developers and platform hosts.

Source: Beazley

Was this article valuable?

Here are more articles you may enjoy.

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’  Kansas Man Sentenced for Insurance Fraud, Forgery

Kansas Man Sentenced for Insurance Fraud, Forgery  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’