The nation’s excess and surplus lines insurance industry is growing almost 13 percent faster halfway through this year than it did last year at this time.

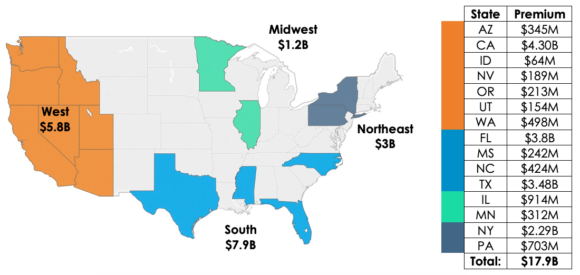

Mid-year premium growth reported by the 15 excess and surplus lines (E&S) stamping/service offices across the country has reached almost $18 billion, based on data reported halfway through 2019. This growth represents a 12.7% increase over what was recorded at mid-year 2018, according to data analyzed by Texas E&S officials.

All but one (Nevada) of the 15 service office states experienced premium increases, while 13 also recorded increases in policy filings. The largest gains were seen in Minnesota (24.6%), Arizona (21.1%), North Carolina (18.9%), California (18.2%) and Idaho (15.7%).

While there are various reasons for the increases in states, Minnesota and California saw increases partially due to late policies (those filed in 2019 but effective in 2018), with California’s premium being affected by several large-scale late policies with premiums of greater than $100 million.

Nicholas Schroeder, executive director, Surplus Lines Association of Minnesota, said he believes his state may only be up 10% in 2019 over mid-year 2018 if a few large transactions with 2018 effective dates are discounted.

Idaho felt the benefit of the home state rule as large property accounts previously recorded elsewhere are now being reported back to the state of Idaho.

On the other hand, Arizona’s 21% increase was attributed to overall increases by policy, with evident changes occurring in construction, professional, and general liability classes, according to Scott Wede, executive director, Surplus Line Association of Arizona.

Similarly, in North Carolina, several class codes had significant changes, most noticeably within property coverages. “This is primarily from rate increases and additional coverage being purchased as a result of the two hurricanes that hit North Carolina in 2018. The remainder of the premium increase this year is due to economic growth in North Carolina,” said Geoff Allen, chief operating officer, North Carolina Surplus Lines Association.

Five (5) other states also reported double-digit premium increases: Mississippi (14.3%), Florida (14.2%), Texas (13.4%), Illinois (11.3%), and Oregon (11.1%).

Peggy Dronet, executive director, Mississippi Surplus Lines Association, said that a favorable economy contributed to her state’s premium growth. “The uptick in the economy has had a huge impact within our state,” Dronet said, “especially in the lower five coastal counties, where over half of the increase was generated.”

This too was the same experience for in Florida. According to Sheila Pearson, controller, Florida Surplus Lines Service Office, her state is seeing a “lot of coverages with double digit increases over last year, higher than the 14% increase in premium.”

Utah recorded the highest increase in filings with a 20.2% growth, followed by Washington at 17.6%. Other states with notable filing growth include Florida (8.71%), Arizona (8.53%), and Mississippi (7.36%).

The mid-year report included modest filing decreases that could easily be attributed to timing/filing differences for agents/brokers in the states of Illinois (0.22%) and Minnesota (1.09%), while Nevada experienced a slight premium decrease of 1.49%.

The Surplus Lines Stamping Office of Texas conducts both the mid-year and an end-of-year analysis. According to Norma Essary, chief executive officer, the slight deductions in a few states are of minor effect given the growth overall.

“The slight reductions are not significant enough to be of concern; however, overall, the mid-year report from our business partners and peers support a number of different factors, all of which include robust state economies, consumer driven need (buyers & risk managers), expanded capacity of the surplus lines market, and a major reason – rate increases,” she said.

The report says that in Texas the 13.4% increase is predominately driven by the hardened market. Carriers are raising their rates across the board while carriers are reassessing risk, loss ratios, market disruptions, profitable coverage lines, and resetting business strategy and operations after years of operating in a soft market, according to Essary.

Topics Trends California Texas Florida Excess Surplus North Carolina Mississippi

Was this article valuable?

Here are more articles you may enjoy.

AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial  Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk