Cowbell Cyber, a startup insurtech using artificial intelligence (AI)-powered cyber insurance for small to mid-sized businesses (SMBs), has added social engineering coverage to its Cowbell Prime 100 cyber insurance product. The update mitigates financial losses from phishing or fraudulent emails.

Social engineering coverage can be added as an endorsement to existing or new policies with a limit up to $250,000 and deductible as low as $10,000. This endorsement complements Cowbell’s Computer and Funds Transfer Fraud coverage which is available with a limit up to $5 million.

As of April 2020, Cowbell Cyber is also opening its platform to all non-policyholders at no cost, giving them direct access to Cowbell Factors and insights into their security risk ratings, along with peer and industry benchmarks.

Businesses can sign up at https://cowbell.insure/for-businesses/ to access a free comprehensive security risk assessment based on Cowbell Factors, Cowbell’s proprietary multi-variant risk ratings factors.

Cowbell Prime 100 provides standalone, admitted cyber insurance coverage to small and mid-size businesses and is distributed through a network of independent agencies with agents able to issue standalone, tailored coverage policies in less than 5 minutes.

Cowbell Cyber maps insurable threats and risk exposures using artificial intelligence to determine the probability of threats and impact on coverage types. Cowbell Insurance Agency is currently licensed in 15 U.S. states and provides SMBs with up to $5 Million of cyber coverage.

Was this article valuable?

Here are more articles you may enjoy.

Marsh McLennan Agency to Acquire The Horton Group

Marsh McLennan Agency to Acquire The Horton Group  Beryl’s Remnants Spawned 4 Indiana Tornadoes, Including an EF-3: NWS

Beryl’s Remnants Spawned 4 Indiana Tornadoes, Including an EF-3: NWS  AT&T Says Data From Around 109M Customer Accounts Illegally Downloaded

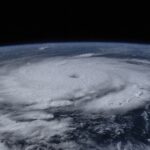

AT&T Says Data From Around 109M Customer Accounts Illegally Downloaded  Damage From Hurricane Beryl May Cost Insurers $2.7B in US, $510M in Caribbean: KCC

Damage From Hurricane Beryl May Cost Insurers $2.7B in US, $510M in Caribbean: KCC