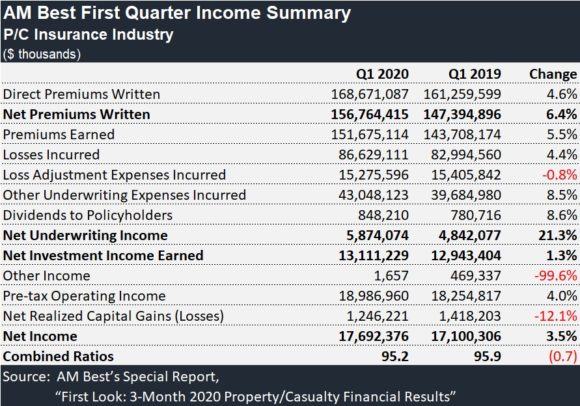

Even though unrealized capital losses pushed surplus down 9 percent from year-end 2019 for the U.S. property/casualty insurance industry, aggregate underwriting profits for first-quarter 2020 were more than 21 percent higher than first-quarter 2019, AM Best reported.

The first-quarter underwriting profit of $5.9 billion translates into a combined ratio of 95.2, 0.7 points lower than the 95.9 ratio recorded for first-quarter 2019.

Net income, which includes $13.1 billion in net investment income and $1.2 billion in net realized investment gains in addition to underwriting income, totaled $17.7 billion—coming in 3.5 percent higher than the $17.1 billion booked in last year’s first quarter.

The figures are based on data derived from carriers’ first-quarter statutory statements that AM Best had received as of May 19, 2020. The companies included in Best’s compilation accounted for an estimated 95 percent of total U.S. P/C industry net premiums and 93 percent of policyholder surplus.

According to Best’s tally, net written premiums climbed 6.4 percent to $156.8 billion, compared to first-quarter 2019. Policyholder surplus as of March 31 was $744.9 billion, down from $820.8 billion at year-end 2019.

The rating agency commented that while the overall impact from the COVID-19 pandemic was limited in the first quarter of 2020, there were greater changes in line of business underwriting results than normal. Personal lines displayed favorable movement, while other lines showed mixed effects, AM Best said, without providing further commentary by line of business.

The report does include direct written premium movements by line, showing premiums for commercial lines like “other liability” jumping nearly 15 percent and workers’ compensation dropping 3.3 percent.

AM Best said its analysts anticipate that underwriting of COVID-19 will become considerably more apparent in second quarter 2020 results.

As for investment results, AM Best Director Jennifer Marshall said that investments overall “seem to have held up well, with the exception of equity holdings.” Total equity holdings were down approximately $103 billion in the first quarter of 2020 compared with the same prior-year period, or about 21 percent. This returned the value of industry’s equity-level holdings to almost its year-end 2018 level, AM Best said in a press statement.

Was this article valuable?

Here are more articles you may enjoy.

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  The $10 Trillion Fight: Modeling a US-China War Over Taiwan

The $10 Trillion Fight: Modeling a US-China War Over Taiwan  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions