CUNA Mutual Group is expanding its digital capabilities by acquiring CuneXus, an online and mobile lending platform.

CUNA Mutual Group became an early-stage investor in CuneXus through its venture capital entity, CMFG Ventures, in 2017. Terms of the transaction were not disclosed.

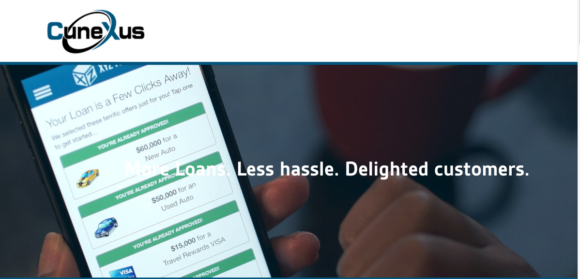

The CuneXus digital marketing and sales platform enables financial institutions to offer pre-approved, “click-to-accept” consumer loans to customers where and when they need them.

The platform uses a combination of a bank’s or credit union’s customer information and lending criteria, as well as customer credit history, behavior and location to identify loan offers for consumers – with no application necessary.

“We are continuing our journey into a more diverse, digital-first world,” said Robert N. Trunzo, president and CEO, CUNA Mutual Group. He said using technology to “enhance consumers’ access to financial solutions that work for them and create a more equitable financial system and society” is a top priority for the insurance and financial services company.

Dave Buerger, CEO, CuneXus, said the two firm’s capabilities and culture “align very well” and he believes CuneXus can “greatly enhance CUNA Mutual Group’s digital evolution in the lending space.”

California-based CuneXus Solutions said it currently works with more than 140 financial institutions. It was named as a start-up to watch on KPMG’s global report of “The 50 Best Fintech Innovators” and the winner of the “Best Consumer Lending Company” in the 2020 Fintech Breakthrough Awards.

CuneXus will continue to operate in its Santa Rosa, California location.

Madison, Wisconsin-based CUNA Mutual Group offers insurance, investment and financial services.

Topics Mergers & Acquisitions

Was this article valuable?

Here are more articles you may enjoy.

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen

Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial