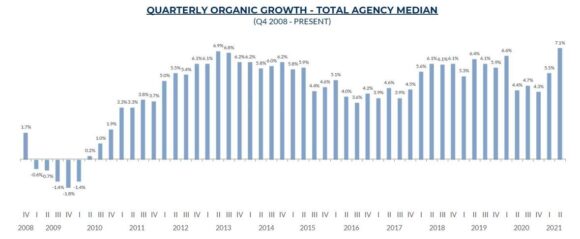

Buoyed by the hard market and rebounding economy, Independent insurance agents and brokers grew overall by 7.1% in the second quarter, surpassing the 6.9% organic growth reported eight years ago in the second quarter of 2013.

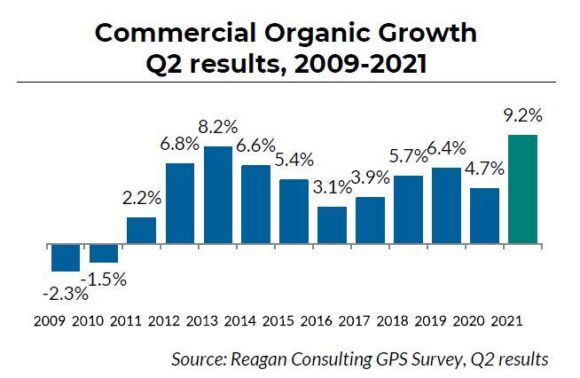

Commercial lines posted an organic growth rate of 9.2%, while the previous Q2 high was 8.2% in 2013.

The quarter saw was the highest organic growth rate in the 13-year history of Reagan Consulting’s Growth & Profitability Survey (GPS).

Individual Lines

With an organic growth rate of 9.2%, commercial lines continued to lead growth, building on a trend from this year’s first quarter. Reagan cited significant premium price increases for several products as helping to push the growth — including a 19.7% increase in umbrella prices followed by an 18.0% increase in cyber prices. Premium hikes for commercial auto, employment practices, commercial property, and directors and offices insurance are also at 9.0% or higher.

Personal lines posted a decline in Q1 2021, but are now rallying with a Q2 2021 organic growth rate of 2.1%, the historical Q2 average.

Group benefits still trail behind their historical averages, but did increase from 2.1% organic growth in Q1 2021 to 3.1% in Q2 2021.

Public Brokers

For the second time in the survey’s history, public brokers surpassed the performance of independent brokers and agents by 2.9 percentage points in Q2 2021, posting an organic growth rate of 10%. According to McNeely this can be explained by the fact that public brokers operate in both national and international arenas, and their broader geographies better capture the benefits of market hardening and economic recovery.

Additionally, public brokers usually write larger accounts, and some of the specialty coverages they sell have seen “dramatic price increases” in early 2021, he said.

Reagan analysts said they anticipate the momentum to continue and they predict a full-year organic growth rate of 7.0% in 2021.

“The hard market in the property-casualty business and the favorable economic environment are expected to continue for the remainder of the year,” said Brian McNeely, Reagan Consulting partner.

“There are still some lingering cost savings from the pandemic, but they are waning,” McNeely added. Pandemic-related cost savings — for example, reduced travel, entertainment, advertising, and auto expenses —contributed to higher margins this year. But he believes these selling expenses should return soon to pre-pandemic levels.

Reagan collects survey results from about 200 mid-size and large agencies.

Source: Reagan Consulting

Was this article valuable?

Here are more articles you may enjoy.

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals  The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets