Overall net income fell at giant Berkshire Hathaway in the third quarter from $30.1 billion a year ago to $10.3 billion this third quarter, reflecting losses on insurance underwriting as well as the continuing effects of global supply chain issues and the pandemic.

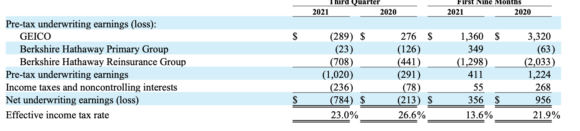

Berkshire’s combined insurance units posted a $784 million pre-tax underwriting loss largely attributable to $1.7 billion in catastrophe claims including claims from Hurricane Ida and flooding in Europe.

Berkshire Hathaway Reinsurance Group lost $708 million on underwriting, while Berkshire Hathaway Primary Group lost $23 million.

Also, auto insurance unit GEICO recorded a $289 million pre-tax underwriting loss due to a rise in claims as insureds drove more this year than during the third quarter 2020 due to pandemic shutdowns. GEICO’s results also reflected earned premium reductions from its pandemic Giveback premium program.

However, GEICO premiums written increased $1.7 billion (19.5%) in the third quarter and $3.1 billion (11.9%) in the first nine months of 2021 compared to 2020.

Insurance investment income of $1.2 billion was up slightly for the quarter, while total insurance revenues topped $19 billion, compared to $17.1 billion for the quarter one year ago.

Total pre-tax insurance earnings for the quarter were $317 million, down from $929 million for last year’s third quarter.

Reinsurance Group

Premiums written by Berkshire Hathaway Reinsurance Group (National Indemnity, General Re. and General Re AG, General Re Life, Life Insurance Company of Nebraska) increased $155 million (3.9%) in the third quarter and $913 million (8.3%) in the first nine months of 2021 compared to the same periods in 2020. The company said the increases reflected net new business, increased participations on renewals, improved prices and favorable foreign currency translation effects.

The reinsurance loss ratio increased 7.9 percentage points in the third quarter and decreased 7.7 percentage points in the first nine months of 2021 compared to 2020. Losses and loss adjustment expenses in 2021 included provisions for estimated liabilities arising from significant catastrophe events of approximately $1.5 billion in the third quarter and $1.9 billion in the first nine months. These provisions were attributable to Hurricane Ida and flooding in Europe in the third quarter and Winter Storm Uri in the first quarter. Estimated losses attributable to significant catastrophes in 2020 were approximately $300 million and derived from Hurricanes Laura and Sally in the third quarter.

Primary Group

Premiums written by Berkshire Hathaway Primary Group (Berkshire Hathaway Specialty Insurance, Homestate, MedPro, GUARD, National Indemnity Co., U.S. Liability Insurance Co., Central States and MLMIC) increased $503 million (16.7%) in the third quarter and $1.8 billion (23.0%) in the first nine months of 2021 compared to 2020, primarily attributable to a 42% year-to-date increase from BH Specialty in professional liability, casualty and property lines of business. In addition, several other underwriting units experienced year-to-date premiums written increases, including MedPro Group (19%), NICO Primary (32%), GUARD (8%) and USLI (20%) in various coverages and markets, partly offset by lower volumes for workers’ compensation business.

BH Primary’s loss ratio declined 3.8 percentage points in the third quarter and 3.4 percentage points in the first nine months of 2021 versus 2020.

Operating Earnings

While Berkshire Hathaway’s overall net income fell in the quarter, the conglomerate’s operating earnings grew by 18% to $6.47 billion, up from $5.48 billion last year.

Berkshire Hathaway subsidiaries include railroad, energy, manufacturing, food and retail businesses in addition to insurance. Over the second half of 2020 and continuing in 2021, Berkshire said many of its businesses experienced “significant recoveries in revenues and earnings, in some instances exceeding pre-pandemic levels.” However, many of were also “negatively affected by ongoing global supply chain disruptions, including those attributable to major winter storms and a hurricane in North America, which contributed to higher input costs.”

Topics Catastrophe Profit Loss

Was this article valuable?

Here are more articles you may enjoy.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme

Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme