This content originally appeared on NCCI’s Insights page. It is used here with permission.

Catastrophes in insurance are generally associated with large losses that occur in the property lines of business, such as from natural disasters. However, the workers compensation (WC) industry is not immune to the impacts of extraordinary loss events. COVID-19 has generated renewed interest in NCCI’s treatment of catastrophic losses in its ratemaking process. This article examines the reflection of catastrophic losses in the ratemaking process, as well as NCCI’s catastrophe provision filed and approved in many states.

TREATMENT OF CATASTROPHIC LOSSES IN RATEMAKING

Typically, loss costs and rates use historical loss data. Catastrophes are low-frequency, high-severity events, and may have the potential to cause billions of dollars in WC losses. The occurrence of such an event in any one year will likely not be representative of future annual expected loss potential. Therefore, NCCI does not rely on historical data for catastrophes, and removes these events from its ratemaking data.

NCCI considers an event to be catastrophic when reported incurred losses across all states exceed $50 million. This threshold is meant to identify any extraordinary loss event that is not viewed as indicative of future losses. Due to its extended duration, the COVID-19 pandemic may be considered somewhat unique when compared with prior WC catastrophic events. Even so, its handling in NCCI’s ratemaking process is consistent with that of prior catastrophic events—as the experience is not viewed as being indicative of future losses.

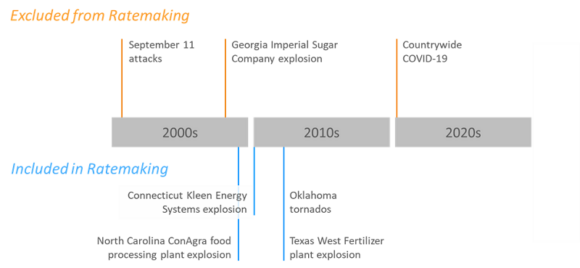

The timeline above, shared at the Annual Insights Symposium 2022, shows it is rare for large event losses to be removed from ratemaking—as costly events exceeding $50 million have been infrequent. However, as indicated above in blue, there have been events with catastrophic potential. While the losses associated with these events were monitored, none of them reached the $50 million threshold.

One of ratemaking’s basic principles is that the loss costs/rates need to account for all future expected losses. NCCI reflects catastrophic exposure in the ratemaking process through a catastrophe provision.

NCCI CATASTROPHE PROVISIONS

The events of September 11 caused NCCI to rethink its approach to catastrophes. It remains the costliest WC catastrophe to date—with more than $3 billion in losses paid. At the time, no provision was in place to help cover the losses. In response, NCCI introduced two catastrophe provisions in the years immediately following. Those provisions reflected the long-term view of future risk.

The first catastrophe provision covers terrorism losses. The amount of the provision was determined through a terrorism catastrophe model that considered the Terrorism Risk Insurance Act (TRIA). Enacted in 2002, TRIA is a federal backstop for insured losses from large-scale acts of terrorism. Because of TRIA, terrorism losses are contemplated separately from all other catastrophes. The approved voluntary loss cost/rate is a half penny in most NCCI jurisdictions.

Prior to COVID-19, the second catastrophe provision covered losses exceeding $50M originating from earthquakes, noncertified acts of terrorism, or industrial accidents. COVID-19 has shown that there are other perils that may result in catastrophic losses. As a result, the definition of catastrophes was broadened to include any event, regardless of the specific peril, exceeding $50 million in aggregate WC losses. The amount of the provision was determined through catastrophe modeling of pandemics, earthquakes, tsunamis, and industrial accidents. The voluntary loss cost/rate is a penny in all jurisdictions where approved.

Given the relatively low-frequency of WC-related catastrophic events, these provisions allow for the collection of catastrophe-related premium over time that may be used to pay for catastrophe-related losses when they occur.

LOOKING FORWARD

Since the implementation of the catastrophe provisions in the early 2000s, NCCI has updated the catastrophe modeling underlying the provisions several times. Based on relevant industry topics, there are a few considerations that may shape NCCI’s understanding of WC catastrophes in years to come.

- How does remote work impact the exposure assumptions underlying the catastrophe models? Exposure may increase due to the blurred line between working and nonworking hours. However, with less geographical concentration of workers, there may be less risk of multiple individuals being injured by the same event.

- Will we see more catastrophic losses generated from a small number of claims, such as a multicar collision? Could the $50 million threshold be reached from a single claim? Today, some of the largest claims reported to NCCI have more than $30 million in case-incurred losses.

- How will climate change impact WC? Storms do not typically generate catastrophic losses due to the lead-time weather models and other advance-warning mechanisms provide. However, more frequency and extreme conditions could amplify the impact of known perils, such as extreme heat, storms, and wildfires, on the WC industry.

Regardless of this uncertainty, the catastrophe provision, and its broadened definition, helps to prepare for possible future extraordinary loss events.

Was this article valuable?

Here are more articles you may enjoy.

AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial  The $10 Trillion Fight: Modeling a US-China War Over Taiwan

The $10 Trillion Fight: Modeling a US-China War Over Taiwan  A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market