Well documented are the pains insurers are facing while trying to keep up with rising claims frequency and severity in auto lines. J.D. Power’s newest study on claims satisfaction reveals the frustration has trickled to consumers.

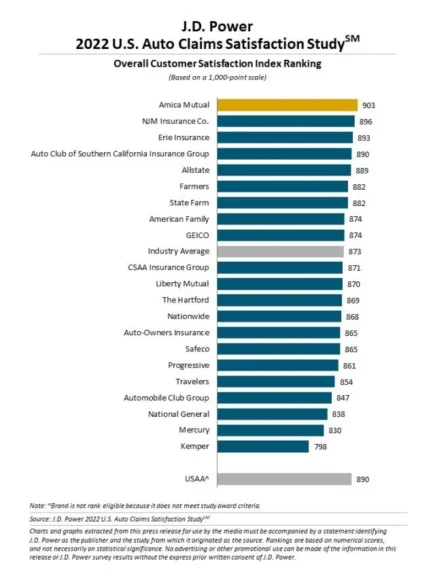

The J.D. Power 2022 U.S. Auto Claims Satisfaction Study found that customer satisfaction has declined 7 points to 873 (on a 1,000-point scale) compared with 2021 as customers start to lose patience with the claims process.

Related: Bad Driving, Inflation Among Factors Pushing Increase in Auto Loss Ratios

Costlier, harder-to-find parts are leading to a longer repair process. J.D. Power said customer satisfaction was down in almost all aspects of the study but satisfaction with the repair process dropped 9 points compared with last year – marking the first time that a majority of customers cited supply chain issues as reasons for delays in getting their vehicle back on the road.

In September J.D. Power reported that increases in auto insurance premiums were affecting some insurers’ bundling strategies.

The average repair cycle time is nearly 17 days, compared with a pre-pandemic average of about 12 days, J.D. Power said.

“Insurers are in a tight spot with their own profitability strained, and a host of external factors causing their customers to grow increasingly disillusioned with the entire claims experience,” said Mark Garrett, director of global insurance intelligence at J.D. Power. “The best way forward is for insurers to start focusing on carefully managing customers’ expectations and fine-tuning their digital engagement strategies to shepherd their customers through the process.”

Managing expectations and remaining in communication with claim updates. J.D. Power said satisfaction scores jumped up when customers are provided with accurate time estimates of claims. “Being empathetic throughout the process is key, especially for the longer-tailed claims that can create more effort for customers who have questions, need updates and are trying to determine next steps,” J.D. Power recommended.

Balancing the use of digital and personal contact channels appears to be a challenge in the industry. Different customers prefer different mixes of communication. About 35% of people said they prefer to work with people but satisfaction is 31 points lower than those who are comfortable with both channels.

As it did for homeowners satisfaction, Amica Mutual ranked the highest in auto insurance satisfaction, according to J.D. Power’s study, which was based on responses from about 8,240 auto insurance customers who settled a claim within six months of taking part in the survey. The study excluded claims of only glass/windshield damage and those who only filed a roadside assistance claim.

Was this article valuable?

Here are more articles you may enjoy.

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Kansas Man Sentenced for Insurance Fraud, Forgery

Kansas Man Sentenced for Insurance Fraud, Forgery  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting