“It was the best of times, it was the worst of times” would be an apt description of the last few years for auto insurers. Immediately after a nationwide, months-long driving hiatus caused collisions to plummet and profits to surge, a toxic cocktail of supply chain disruptions, increases in the frequency and severity of collisions and a complete dislocation in used-vehicle prices drove loss ratios into the red for many auto insurance companies. Through the end of 2022, auto insurer losses and expenses continued to outpace premium growth for major industry players. While some of those trends have now started to change course, the myriad challenges facing the industry are far from solved.

Chief among these is the issue of frothy used-vehicle pricing. Prices for used cars surged roughly 50% through February of 2022 while auto insurance contract pricing systems predicted car values would continue to go down with a constant depreciation – a generally accepted trend for the last several decades of experience in retail used car valuation.

Used-vehicle prices continued to stay elevated throughout 2022 and, just in the past two months, they have begun to recede. However, as the auto industry continues to be transformed by the introduction of EVs and volatile swings in supply and demand become the norm, these once-in-a-lifetime anomalies are likely to happen a lot more frequently.

Depreciation Curves Missed the Mark

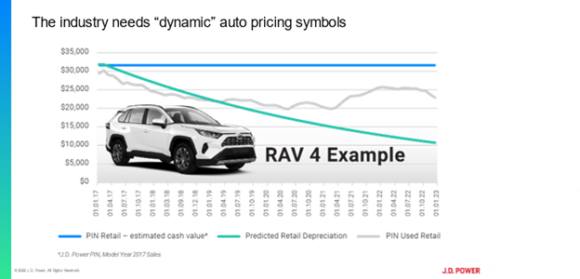

To illustrate the trend, take the recent replacement cost pricing data on a Toyota RAV4. In January 2017, the estimated cash value of a 2017 model-year RAV4 was about $30,000. Under historical conditions (omitting the recent three years), the predicted retail price of that car today would be about $10,000. In reality, however, if someone wanted to replace a used 2017 RAV4 today, the real market value would be more like $23,000. Predicting a pay-out of $10,000 with an actual payout of $23,000 makes an implicit 230% “uh-oh” for insurers.

That gap—the $13,000 difference between what insurers using historical pricing models had anticipated and the reality they encountered during the past few years—tells you everything you need to know about threats to P&C insurer profitability in today’s unpredictable economy. It also helps quantify the scale of financial loss insurers are absorbing, beyond what was projected, especially when one factors in a record number of collisions, rising costs of replacement parts and more total losses than ever before.

Rising Premiums, Bleeding Customer Loyalty

Insurers have responded to this phenomenon with the only tool they’ve had readily available: higher premiums. In fact, the average auto insurance premium rose 9% in 2022, and is projected to rise another 8.4% this year, as insurers scramble to make up for the shortfall. Raising premiums in this manner does not come without consequences, however. Across all of our auto insurance studies during the past two years, we’ve seen steady declines in customer satisfaction, growing consumer frustration with the auto claims process and a surge in value shopping as consumers hunt for alternatives.

All three of these trends run counter to the P&C playbook of maximizing profitability by building lifetime customer value. It doesn’t matter how compelling an insurer’s bundling offers are or how well they are targeting the high value “Robinsons” segment; if they cannot get their premium formulas in line with a more realistic vehicle valuation strategy, insurers will bleed customer loyalty.

Building a Predictive Premium Strategy

The solution to all of this comes in the form of more accurate pricing models that are based not only on historical trends, but on a deeper understanding of individual vehicle attributes and values, along with continuous underwriting and risk pricing using observational data like mileage, routes traveled and driver behavior. These new, tailored valuation methods can create the in-market values per vehicle based on an individual vehicle identification number (VIN), which outperforms a one-size-fits-all depreciation curve, because that curve has now been shown to be woefully unreliable.

The data and the sophisticated analytics needed to crunch it are all readily available today. It is possible, for example, to construct a dynamic RAV4 pricing model that includes individual features and packages, driver behavior and real-time replacement cost and to factor that cost into the premium offered to the customer. Maybe RAV4 prices will start trending up again. Maybe they’ll go down. Maybe the driver is a super-cautious backroad cruiser with three other auto policies and a home policy with the same carrier. Maybe that driver is a speed demon delivering Uber Eats in a densely populated city. With today’s advanced, dynamic pricing models, these variables can be factored into a highly customized, person- and vehicle-specific premium offer.

The craziest risks with the most unfactored variables tend to find a home at those insurance companies with lagging analytics and weaker risk-based technology where an inadequate rate slowly boils higher with broad brushed rate hikes. The stronger, more resilient companies in this space offer personalized risk rating at better prices and select away the most favorable risks. This is a tale as old as time with some companies hitting the century mark and others ceasing to exist.

Before insurers can reap the benefits of these technological advances, however, they are going to have to abandon the decades-old practice of using a one-size-fits-all decreasing factor model for all vehicles. Instead, they must adopt instead an actual cash value approach for today’s-and-tomorrow’s risk exposures. Now that used-vehicle prices may have crested, insurers need to ask themselves: Can we afford to keep operating on a business-as-usual level, or is there a large gap between our actual costs of doing business and what we charge customers for making those promises?

Was this article valuable?

Here are more articles you may enjoy.

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh

Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call